Welcome to Our Research Archive

Search and filter by content type, issue area, author, and keyword

- ✕ Clear Filter

- Artificial Intelligence (1)

- Child Welfare (44)

- Child Welffare (1)

- Civil Society (34)

- Economic Opportunity (1)

- Economic Security (104)

- Economic Well-Being (1)

- Education (204)

- Family (113)

- Featured (4)

- Fmaily (1)

- Fraud (1)

- Housing (106)

- Housing Supply (1)

- Marriage (1)

- Safety Net (221)

- Social Capital (43)

- Social Captial (1)

- tax credit (1)

- Welfare (2)

- Workforce (113)

- Workforce Development (3)

- Workfrce (1)

- Workfroce (1)

- Workorce (1)

- ✕ Clear Filter

- Adam J. White (1)

- Angela Rachidi (62)

- Beth Akers (38)

- Brent Orrell (101)

- Bruce D. Meyer (15)

- Casey B. Mulligan (1)

- Charles Murray (1)

- Daniel A. Cox (11)

- Edward J. Pinto (26)

- Edward L. Glaeser (10)

- Frederick M. Hess (40)

- Greg Wright (1)

- Howard Husock (90)

- Ian Rowe (15)

- James C. Capretta (1)

- James Pethokoukis (20)

- John Bailey (2)

- Joseph Fuller (5)

- Kevin Corinth (76)

- Kyle Pomerleau (9)

- Leslie Ford (6)

- marie cohen (1)

- Mark Schneider (9)

- Mason M. Bishop (2)

- Matt Weidinger (83)

- Matthew Continetti (1)

- Max Eden (3)

- Michael Barone (1)

- Michael Brickman (3)

- Michael Pugh (2)

- Michael R. Strain (34)

- Naomi E. Feldman (1)

- Naomi Schaefer Riley (67)

- Nat Malkus (21)

- Nicholas Eberstadt (5)

- Paul Ryan (3)

- Preston Cooper (37)

- R. Glenn Hubbard (4)

- Ramesh Ponnuru (5)

- Raphael Colard (1)

- Richard Burkhauser (8)

- Richard V. Burkhauser (4)

- Robert Cherry (6)

- Robert Doar (14)

- Robert Pondiscio (18)

- Ross Douthat (2)

- Ryan Streeter (5)

- Sally Satel (2)

- Samuel J. Abrams (7)

- Scott Winship (61)

- Stan Veuger (10)

- Timothy P. Carney (16)

- Tobias Peter (34)

- W. Bradford Wilcox (86)

- Yuval Levin (10)

August 15, 2024

Kamala Harris Will Pay You Not to Work

A recent study confirms that universal basic income—no-strings-attached benefit checks offered to recipients regardless of need or contribution to the program—discourages work. That’s relevant to the presidential race. Kamala Harris has called more than once for paying UBI-like benefits. Participants in the UBI program worked nearly 1½ hours less a week on average, and unemployment rose. Other adults in…

August 15, 2024

Women Want More Children Than They’re Having. America Can Do More to Help

In the wake of the media storm generated by Republican vice presidential candidate J.D. Vance’s comment about “childless cat ladies,” fertility in America has vaulted to the top of the national conversation, with good reason. The fertility rate has hit a record low in the United States, with the average American woman now expected to have just…

August 7, 2024

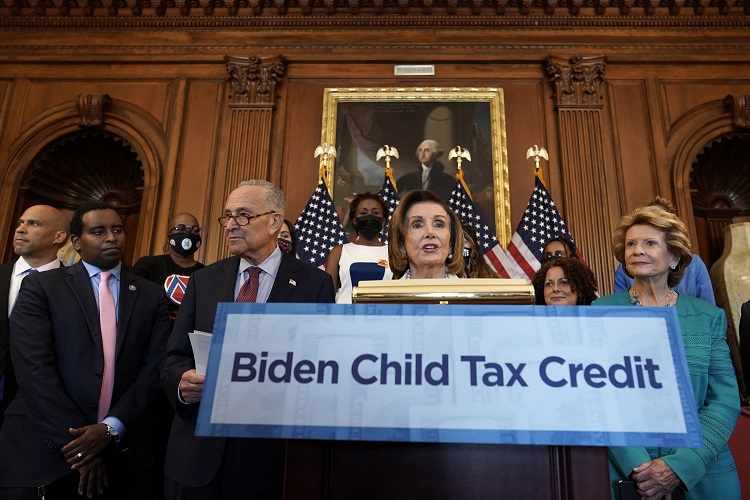

A Bipartisan Solution to the Child Tax Credit Impasse

Last week, the Senate rejected a child tax credit revision that had bipartisan House support. It would have enabled more of the credit to be refundable to families with no employment income. Republican senators voted against it because they believed that providing unconstrained income to poor households would reduce their work effort. This was one of…

August 6, 2024

Trump’s Tax Law Diminished Incentives for Charitable Giving, But We Can Fix It

Debate over the potential renewal of the so-called Trump tax cuts of 2017 will be building as their expiration approaches next year. The focus will likely be on corporate and personal tax rates. But there’s a less-appreciated but consequential side effect of the Tax Cuts and Jobs Act: its impact on charitable giving. Simply put,…

August 5, 2024

Are Opportunity Zones an Effective Place-Based Policy?

When Congress passed and President Trump signed into law the Tax Cuts and Jobs Act at the end of 2017, most attention centered on the reduction in the corporate tax rate and overhaul of the individual tax code. Few noticed a provision added at the last minute establishing a new place-based policy in the United…

August 2, 2024

Democrats’ Automatic Stimulus Proposals Undermine the Administration’s “Strongest Economy” Claims

Today’s US jobs report finds the nation’s unemployment rate increased to 4.3 percent in July. According to a measure often cited by liberal policymakers, that suggests the US has entered a recession, undercutting President Biden’s boast just last week that the US has “the strongest economy in the world.” That grinding contradiction is only reinforced…

August 1, 2024

Financing Graduate Education: Next Steps for Federal Policy

Key Points Read the full pdf.

August 1, 2024

Two Outrageous Bills Kamala Harris Sponsored Would Crush Taxpayers

As a U.S. senator, Vice President Kamala Harris had a remarkably slim record of accomplishments, shepherding only a handful of minor resolutions across the finish line. But that’s far from the last word on her legislative record. In fact, two bills she introduced (that went nowhere) may best define her past, and potential future, priorities…

July 29, 2024

The Rise of ‘Marriage Deserts’ and What We Can Do About Them

What makes a marriage succeed or fail? To answer this question, psychologist John Gottman set up what came to be known as the “Love Lab” at the University of Washington in Seattle. Couples were invited to spend a weekend in a plush apartment with scenic views as Gottman and his team monitored their body language,…

July 29, 2024

The Real Impact of Zoning and Land Use Reforms Contrary to the Urban Institute’s Claims

Not in my backyard (NIMBY) adherents across the country are beginning to weaponize a recent Urban Institute study that reviewed 180 zoning reforms and concluded these reforms barely affected the housing supply. Given Urban’s wide distribution and the paper’s seemingly comprehensive approach, coupled with the eagerness of NIMBYs to exploit such research, housing supply advocates need to be aware…