Welcome to Our Research Archive

Search and filter by content type, issue area, author, and keyword

- ✕ Clear Filter

- Adam J. White (1)

- Angela Rachidi (65)

- Beth Akers (39)

- Brent Orrell (108)

- Bruce D. Meyer (15)

- Casey B. Mulligan (1)

- Charles Murray (1)

- Daniel A. Cox (11)

- Edward J. Pinto (31)

- Edward L. Glaeser (10)

- Frederick M. Hess (40)

- Greg Wright (1)

- Howard Husock (91)

- Ian Rowe (15)

- James C. Capretta (1)

- James Pethokoukis (21)

- John Bailey (2)

- Joseph Fuller (6)

- Kevin Corinth (77)

- Kyle Pomerleau (9)

- Leslie Ford (6)

- marie cohen (1)

- Mark Schneider (9)

- Mason M. Bishop (2)

- Matt Weidinger (86)

- Matthew Continetti (1)

- Max Eden (3)

- Michael Barone (1)

- Michael Brickman (3)

- Michael Pugh (2)

- Michael R. Strain (36)

- Naomi E. Feldman (1)

- Naomi Schaefer Riley (75)

- Nat Malkus (21)

- Nicholas Eberstadt (5)

- Paul Ryan (3)

- Preston Cooper (41)

- R. Glenn Hubbard (4)

- Ramesh Ponnuru (5)

- Raphael Colard (1)

- Richard Burkhauser (8)

- Richard V. Burkhauser (4)

- Robert Cherry (6)

- Robert Doar (14)

- Robert Pondiscio (18)

- Ross Douthat (2)

- Ryan Streeter (5)

- Sally Satel (2)

- Samuel J. Abrams (7)

- Scott Winship (63)

- Stan Veuger (10)

- Timothy P. Carney (16)

- Tobias Peter (37)

- W. Bradford Wilcox (91)

- Yuval Levin (10)

April 9, 2025

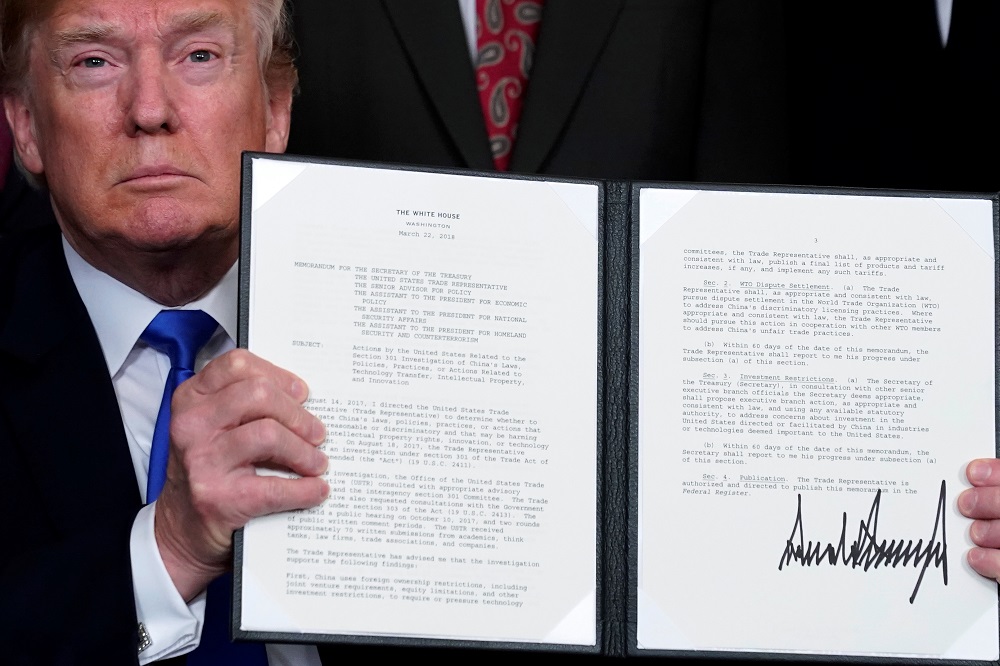

Trump’s Tariff Formula Is Still Wrong. Maybe That’s Why No One Will Admit They Created It.

Last Friday, we showed that the Trump Administration’s tariff formula contained an error that made its calculated tariffs up to four times too large. The entire premise of the administration’s approach—that a country’s tariff and non-tariff trade barriers can be derived solely from the bilateral trade balance with that country, and that the goal of…

April 8, 2025

Discussing President Trump’s tariff formula miscalculation: Corinth on CNN News Central

Kevin Corinth, Deputy Director of the Center on Opportunity and Social Mobility, discusses President Trump’s tariff formula alongside AEI’s Stan Veuger on CNN News Central.

April 4, 2025

President Trump’s Tariff Formula Makes No Economic Sense. It’s Also Based on an Error.

President Trump on Wednesday announced tariffs on practically every foreign country (and some non-countries), ranging from a 10 percent minimum all the way up to 50 percent. The economic fallout has been dramatic, with the stock market losing nine percent of its value (based on the S&P 500 index at the time of writing) and…

October 21, 2024

Dueling Child Tax Credit Proposals: Harris vs. Vance

JD Vance and Kamala Harris have at least one thing in common: proposals to expand the child tax credit (CTC). Currently, the CTC offers households up to $2,000 per child under the age of 17. It phases in as wages exceed $2,500 (an incentive to work) and phases out for high-income workers (a disincentive to…

October 7, 2024

Presidential Candidates’ Dueling Child Credit Expansions Explained

The Trump-Vance and Harris-Walz presidential campaigns have each recently proposed large expansions to the child tax credit (CTC). Both proposals might be intended to appeal to similar voters, but they vary significantly regarding budgetary cost, distribution of benefits, and effect on work incentives. This article compares the proposed expansions with the current Tax Cuts and Jobs…

July 24, 2024

Housing and the American Worker

As the American Worker Project analysis shows, real wages have increased over time. Real wages are nominal wages corrected for changes in the price level, and a natural approach to understanding the way in which housing policy affects real wages is through (housing) prices. But the importance of housing to the economic well-being of the typical American…

March 27, 2024

Perspectives on Place-Based Policy: Strategies for Workforce and Economic Development

Read the full pdf.

October 26, 2023

Working from Density

Is the COVID-19-driven surge in remote work temporary or permanent? To assess how the geography of work may evolve, we analyze the pre-pandemic status quo. Casual theorizing might suggest that workers with teleworkable jobs in the pre-pandemic era were more likely to live in the less dense, peripheral neighborhoods in their metropolitan area. Instead, we…

October 23, 2023

Spatial Spillovers and the Effects of Fiscal Stimulus: Evidence from Pandemic-Era Federal Aid for State and Local Governments

Abstract We analyse whether US federal aid to state and local governments impacted economic activity through either direct or cross-state spillover effects during the COVID-19 pandemic. Deploying an instrumental-variables framework rooted in the funding advantage of states that are over-represented in Congress, we find that federal assistance had significantly less impact on state and local…

July 18, 2023

The Great Recession, COVID-19, Interest Hikes Left a 15-Year Mark on Housing

How have the Great Recession in 2007, the COVID-19 pandemic that hit in 2020, and the Federal Reserve’s interest rate hikes that started in 2022 affected mortgages in the region? Here’s the short answer: Each year, researchers at George Washington University use the State of the Capital Region report to do a deep dive on a policy…