Welcome to Our Research Archive

Search and filter by content type, issue area, author, and keyword

December 5, 2024

SNAP and the “Make America Healthy Again” Agenda

President Trump has committed to “Make America Healthy Again.” Part of the solution will involve addressing issues within the federal government’s nutrition assistance programs. His nominees to lead the Department of Health and Human Services (DHHS) and the US Department of Agriculture (USDA) will play a pivotal role in advancing this agenda. Nearly six in 10 Americans…

December 3, 2024

Avoiding an Unemployment Loan Bailout

Taxpayers in most states may have dodged a billion-dollar bullet on election day. That is, if the outcome had been different, liberal lawmakers would have been uniquely positioned to bail out California and New York unemployment benefit debts, and in the process shift large costs onto taxpayers in other states. All states levy payroll taxes…

November 7, 2024

Key Data on Federal Benefits Paid to Illegal Immigrant Households

Soaring illegal immigration during the Biden-Harris administration was a major campaign theme, with a pre-election Harvard poll finding Americans considered immigration the second-most important issue—right behind inflation and ahead of the economy. An AP exit poll seconded that ranking, with 39 percent of voters citing the economy as their top issue, followed by immigration at 20 percent—up from three…

October 21, 2024

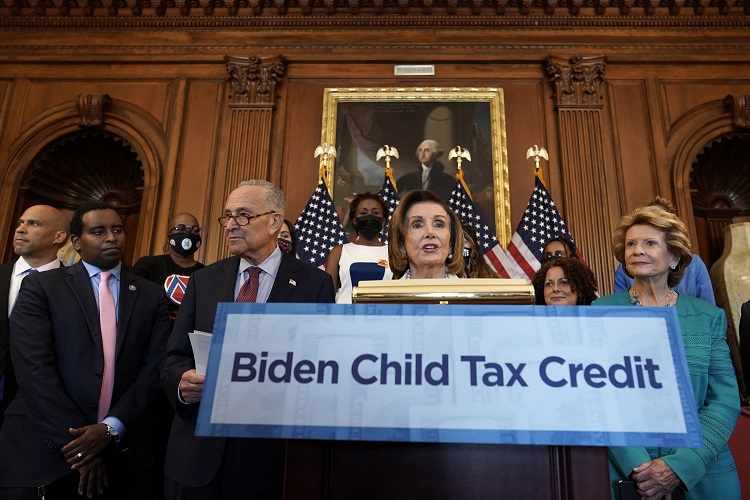

Dueling Child Tax Credit Proposals: Harris vs. Vance

JD Vance and Kamala Harris have at least one thing in common: proposals to expand the child tax credit (CTC). Currently, the CTC offers households up to $2,000 per child under the age of 17. It phases in as wages exceed $2,500 (an incentive to work) and phases out for high-income workers (a disincentive to…

October 18, 2024

Pro-Marriage Conservatives Should Reject a Per-Child Phase-In of the Child Tax Credit

Earlier this week, scholars from the Ethics and Public Policy Center, the Niskanen Center, and other right-of-center organizations issued a memo calling for pro-family tax reforms during the upcoming debate over the future of the Tax Cuts and Jobs Act. While reasonable arguments can be made for most of their proposed reforms, their recommendation to phase in…

August 7, 2024

A Bipartisan Solution to the Child Tax Credit Impasse

Last week, the Senate rejected a child tax credit revision that had bipartisan House support. It would have enabled more of the credit to be refundable to families with no employment income. Republican senators voted against it because they believed that providing unconstrained income to poor households would reduce their work effort. This was one of…

August 2, 2024

Democrats’ Automatic Stimulus Proposals Undermine the Administration’s “Strongest Economy” Claims

Today’s US jobs report finds the nation’s unemployment rate increased to 4.3 percent in July. According to a measure often cited by liberal policymakers, that suggests the US has entered a recession, undercutting President Biden’s boast just last week that the US has “the strongest economy in the world.” That grinding contradiction is only reinforced…

July 17, 2024

Key Takeaways from a New Report on Potential Unemployment Insurance Reforms

Yesterday, the National Academy of Social Insurance (NASI) released the final report of its Unemployment Insurance (UI) Task Force, of which I am a member. The task force was created in December 2020, as state UI agencies were besieged by record pandemic benefit claims and unprecedented fraud. I was one of several members added in late 2023. The purpose…

June 17, 2024

Fixing the Roof on Sunny Days—and Other Lessons in Administering Unemployment Benefits

A recent hearing of the House Ways and Means Subcommittee on Work and Welfare confirmed that the financing of the nation’s Unemployment Insurance (UI) system is enormously complicated. Even the name of the federal payroll tax (FUTA—short for the Federal Unemployment Tax Act that authorizes it and pronounced “few-ta”) is confusing. That complexity sent subcommittee members searching…

May 22, 2024

Missed Opportunities in the Proposed Farm Bill

House Agriculture Committee Chairman Glenn Thompson’s proposed Farm Bill reauthorization, The Farm, Food, and National Security Act of 2024, heads to committee markup today. The Farm Bill is a tough reauthorization normally, and even more difficult in a tightly divided House. While there are provisions that would improve the program, Supplemental Nutrition Assistance Program (SNAP) needs…