Welcome to Our Research Archive

Search and filter by content type, issue area, author, and keyword

April 17, 2025

Turn Public Service Loan Forgiveness into a State Block Grant

…more often about protecting professionals in the field from competition than truly improving standards. While proponents argue that PSLF encourages graduates to choose careers in public service, the incentives are more complex….

April 15, 2025

Utah Hands Parents the Keys to the App Store

…trusted turned out to be little more than window dressing. Stories like this are heartbreaking, and all too common. As parents and policymakers, we can’t stand by while a digital…

April 9, 2025

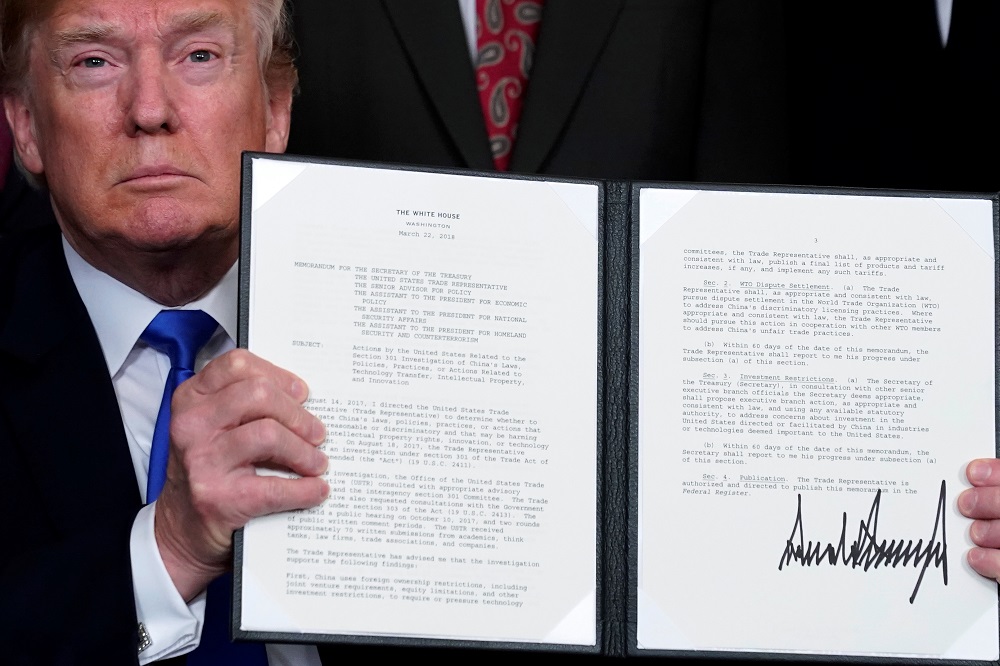

Trump’s Tariff Formula Is Still Wrong. Maybe That’s Why No One Will Admit They Created It.

Last Friday, we showed that the Trump Administration’s tariff formula contained an error that made its calculated tariffs up to four times too large. The entire premise of the administration’s…

April 8, 2025

Discussing President Trump’s tariff formula miscalculation: Corinth on CNN News Central

Kevin Corinth, Deputy Director of the Center on Opportunity and Social Mobility, discusses President Trump’s tariff formula alongside AEI’s Stan Veuger on CNN News Central….

April 4, 2025

President Trump’s Tariff Formula Makes No Economic Sense. It’s Also Based on an Error.

…31% 10.0% Switzerland 31% 10.0% Algeria 30% 10.0% Nauru 30% 10.0% South Africa 30% 10.0% Pakistan 29% 10.0% Tunisia 28% 10.0% Kazakhstan 27% 10.0% India 26% 10.0% South Korea 25%…

March 31, 2025

Reimagining Federal Education R&D: DARPA for Education

…one person left in NCER, there simply won’t be anybody with the right experiences and standing to improve EDU. What happens next to NCER is unclear. If we assume that…

March 31, 2025

Tom Cotton Should Go Further: An Endowment Tax Should Not Exclude Big Foundations

…Even more important, by raising taxes on foundations, Congress can help pay for a change in the tax law to restore an incentive for individual taxpayers to make charitable contributions. As it stands,…

March 28, 2025

Cracking the Code Behind Dismal 8th Grade Reading Scores

…curriculum and standards hints at a serious problem: There is no immediate or obvious solution at hand to address the problem. Nor is it simply a lack of appropriate curriculum…

March 28, 2025

Unfreezing New York’s Projects

…new buildings erected, and tenants moved into the new apartments that become available. The experienced private developers will be responsible for interim repairs on the old, leaky buildings still standing….

March 27, 2025

The Looming Debt Crisis, the Trump Tax Cuts, and Medicaid

…misunderstands how other countries fund their more expansive safety nets. Looking at how countries in the Organisation for Economic Co-operation and Development (OECD) tax their citizens, the United States stands…