Welcome to Our Research Archive

Search and filter by content type, issue area, author, and keyword

- ✕ Clear Filter

- Angela Rachidi (11)

- Beth Akers (15)

- Brent Orrell (40)

- Daniel A. Cox (1)

- Edward J. Pinto (1)

- Frederick M. Hess (1)

- Greg Wright (1)

- Howard Husock (6)

- James C. Capretta (1)

- James Pethokoukis (18)

- Kevin Corinth (13)

- Kyle Pomerleau (6)

- Leslie Ford (2)

- Mark Schneider (5)

- Matt Weidinger (24)

- Michael Brickman (1)

- Naomi Schaefer Riley (1)

- Nat Malkus (7)

- Nicholas Eberstadt (2)

- Preston Cooper (21)

- Raphael Colard (1)

- Robert Cherry (1)

- Robert Doar (4)

- Robert Pondiscio (4)

- Samuel J. Abrams (5)

- Scott Winship (6)

- Stan Veuger (3)

- Tobias Peter (5)

July 30, 2025

It’s Not Surprising That No-Strings Attached Cash Didn’t Help Kids

A recent study put to the test an idea that has become increasingly influential over the past decade: To help kids thrive, one of the best things you can do is to give their parents cash with no strings attached. This idea was the impetus in 2021 for the one-year replacement of the existing Child Tax Credit—which…

May 29, 2025

How Non-disabled Medicaid Recipients Without Children Spend Their Time

The reconciliation bill passed by the United States House of Representatives imposes community engagement requirements for childless non-disabled Medicaid recipients age 19–64, starting in 2027. The requirement can be met by spending 80 hours in at least some months either working, going to school, participating in a work program, or doing community service. In a…

May 28, 2025

An Evaluation of Approaches to Cut and Reform SNAP

House Republicans narrowly passed their version of President Trump’s “big, beautiful bill” last week, and the legislation contains major changes to SNAP, including expanded work requirements, reduced federal and state exemptions and shifting more of the costs to states. Changes are likely as the Senate takes up the bill, and Kevin Corinth, senior fellow and deputy…

April 9, 2025

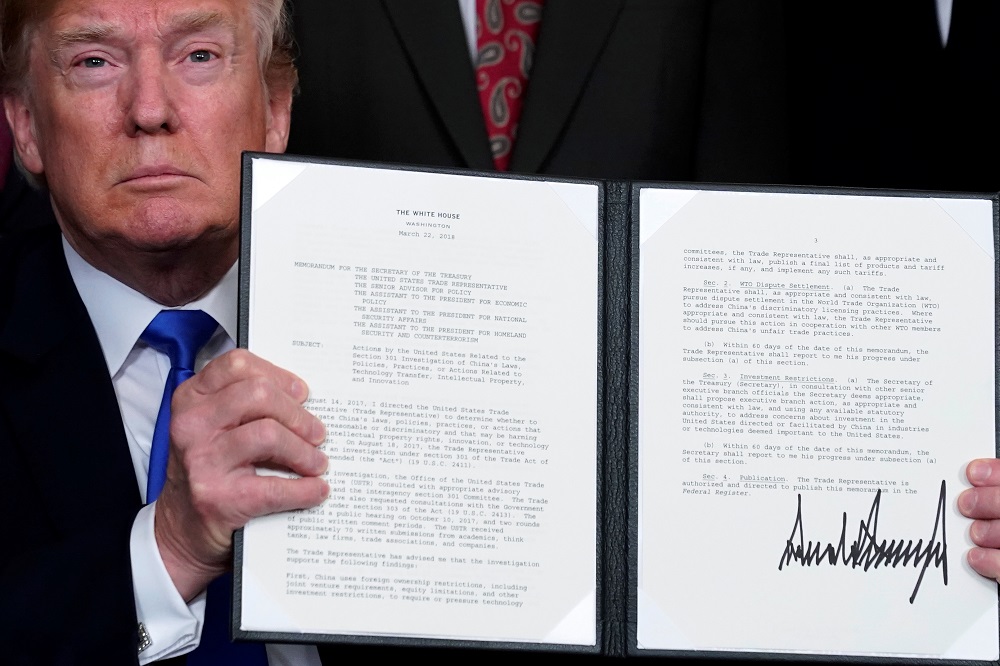

Trump’s Tariff Formula Is Still Wrong. Maybe That’s Why No One Will Admit They Created It.

Last Friday, we showed that the Trump Administration’s tariff formula contained an error that made its calculated tariffs up to four times too large. The entire premise of the administration’s approach—that a country’s tariff and non-tariff trade barriers can be derived solely from the bilateral trade balance with that country, and that the goal of…

April 4, 2025

President Trump’s Tariff Formula Makes No Economic Sense. It’s Also Based on an Error.

President Trump on Wednesday announced tariffs on practically every foreign country (and some non-countries), ranging from a 10 percent minimum all the way up to 50 percent. The economic fallout has been dramatic, with the stock market losing nine percent of its value (based on the S&P 500 index at the time of writing) and…

March 13, 2025

Two Charts Show Why a Trade War Over Fentanyl Doesn’t Make Sense

Following a month-long pause, President Trump last week reimposed tariffs on Canada and Mexico, only to pause many of them again two days later. Different reasons have been offered by the Trump Administration for the tariffs, but in recent days the President’s advisers have honed in on one reason in particular: Fentanyl is being shipped across our borders with…

February 28, 2025

Less Than Half of Medicaid Recipients Work Enough to Comply With a Work Requirement

Congress is considering implementing work requirements for Medicaid. This reform could help Congress achieve its goal of reducing federal expenditures and simultaneously strengthen the incentive for Medicaid recipients to work. At the same time, individuals who do not comply with the work requirement may lose health insurance coverage. Underlying the policy debate is the extent…

February 4, 2025

The Family First Act Would Expand Net Income Tax Refunds to Higher Income Families

Some pro-family conservatives are rallying around Rep. Blake Moore’s (R-UT) Family First Act. Relative to a clean extension of the Tax Cuts and Jobs Act, the bill would cost an additional $575 billion over the next decade in order to increase the generosity of tax breaks targeted at families with children. The bill would lead over half of tax filers…

October 18, 2024

Pro-Marriage Conservatives Should Reject a Per-Child Phase-In of the Child Tax Credit

Earlier this week, scholars from the Ethics and Public Policy Center, the Niskanen Center, and other right-of-center organizations issued a memo calling for pro-family tax reforms during the upcoming debate over the future of the Tax Cuts and Jobs Act. While reasonable arguments can be made for most of their proposed reforms, their recommendation to phase in…

April 9, 2024

The Child Tax Credit: My Long-Read Q&A with Kevin Corinth

The Child Tax Credit is a tax benefit available to many American families for the purpose of reducing their federal income tax liability. It’s specifically designed to help offset the cost of raising children. The CTC of today, however, differs starkly from its pre-pandemic structure. Many economists, including Kevin Corinth, think that the post-pandemic changes were a step…