Welcome to Our Research Archive

Search and filter by content type, issue area, author, and keyword

May 29, 2025

How Non-disabled Medicaid Recipients Without Children Spend Their Time

The reconciliation bill passed by the United States House of Representatives imposes community engagement requirements for childless non-disabled Medicaid recipients age 19–64, starting in 2027. The requirement can be met…

May 28, 2025

An Evaluation of Approaches to Cut and Reform SNAP

…and shifting more of the costs to states. Changes are likely as the Senate takes up the bill, and Kevin Corinth, senior fellow and deputy director of the Center on…

April 9, 2025

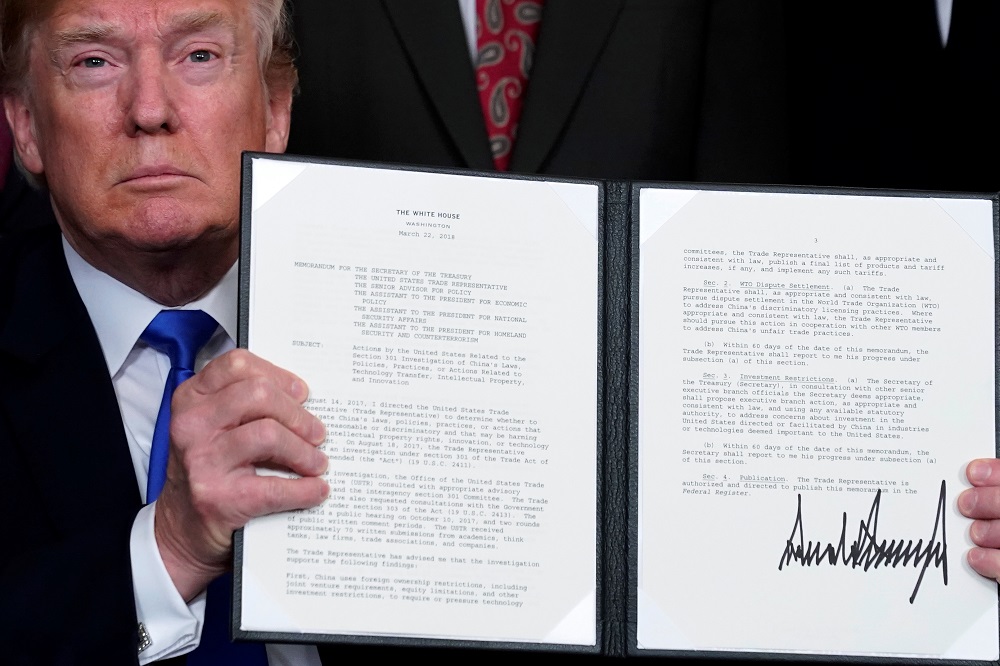

Trump’s Tariff Formula Is Still Wrong. Maybe That’s Why No One Will Admit They Created It.

…President chose to go with a formula related to closing trade deficits, suggested by someone else in the administration.” National Economic Council Director Kevin Hassett, meanwhile, pointed to the US…

April 4, 2025

President Trump’s Tariff Formula Makes No Economic Sense. It’s Also Based on an Error.

President Trump on Wednesday announced tariffs on practically every foreign country (and some non-countries), ranging from a 10 percent minimum all the way up to 50 percent. The economic fallout…

March 13, 2025

Two Charts Show Why a Trade War Over Fentanyl Doesn’t Make Sense

Following a month-long pause, President Trump last week reimposed tariffs on Canada and Mexico, only to pause many of them again two days later. Different reasons have been offered by…

February 28, 2025

Less Than Half of Medicaid Recipients Work Enough to Comply With a Work Requirement

Congress is considering implementing work requirements for Medicaid. This reform could help Congress achieve its goal of reducing federal expenditures and simultaneously strengthen the incentive for Medicaid recipients to work….

February 4, 2025

The Family First Act Would Expand Net Income Tax Refunds to Higher Income Families

Some pro-family conservatives are rallying around Rep. Blake Moore’s (R-UT) Family First Act. Relative to a clean extension of the Tax Cuts and Jobs Act, the bill would cost an additional $575 billion over the…

October 18, 2024

Pro-Marriage Conservatives Should Reject a Per-Child Phase-In of the Child Tax Credit

Earlier this week, scholars from the Ethics and Public Policy Center, the Niskanen Center, and other right-of-center organizations issued a memo calling for pro-family tax reforms during the upcoming debate over the…

April 9, 2024

The Child Tax Credit: My Long-Read Q&A with Kevin Corinth

…raising children. The CTC of today, however, differs starkly from its pre-pandemic structure. Many economists, including Kevin Corinth, think that the post-pandemic changes were a step in the wrong direction. Corinth…

February 12, 2024

Millennials Are Doing Better than You Probably Think

…Five Generations of Americans” by my AEI colleague Kevin Corinth and Jeff Larrimore of the Federal Reserve Board. The economists compared income levels at ages 36–40 across the five generations,…