Welcome to Our Research Archive

Search and filter by content type, issue area, author, and keyword

- ✕ Clear Filter

- Angela Rachidi (11)

- Beth Akers (15)

- Brent Orrell (34)

- Daniel A. Cox (1)

- Edward J. Pinto (1)

- Frederick M. Hess (1)

- Greg Wright (1)

- Howard Husock (6)

- James C. Capretta (1)

- James Pethokoukis (17)

- Kevin Corinth (12)

- Kyle Pomerleau (6)

- Leslie Ford (2)

- Mark Schneider (5)

- Matt Weidinger (24)

- Michael Brickman (1)

- Naomi Schaefer Riley (1)

- Nat Malkus (7)

- Nicholas Eberstadt (2)

- Preston Cooper (19)

- Raphael Colard (1)

- Robert Cherry (1)

- Robert Doar (4)

- Robert Pondiscio (4)

- Samuel J. Abrams (5)

- Scott Winship (6)

- Stan Veuger (3)

- Tobias Peter (5)

May 29, 2025

How Non-disabled Medicaid Recipients Without Children Spend Their Time

The reconciliation bill passed by the United States House of Representatives imposes community engagement requirements for childless non-disabled Medicaid recipients age 19–64, starting in 2027. The requirement can be met…

May 28, 2025

An Evaluation of Approaches to Cut and Reform SNAP

House Republicans narrowly passed their version of President Trump’s “big, beautiful bill” last week, and the legislation contains major changes to SNAP, including expanded work requirements, reduced federal and state exemptions…

April 9, 2025

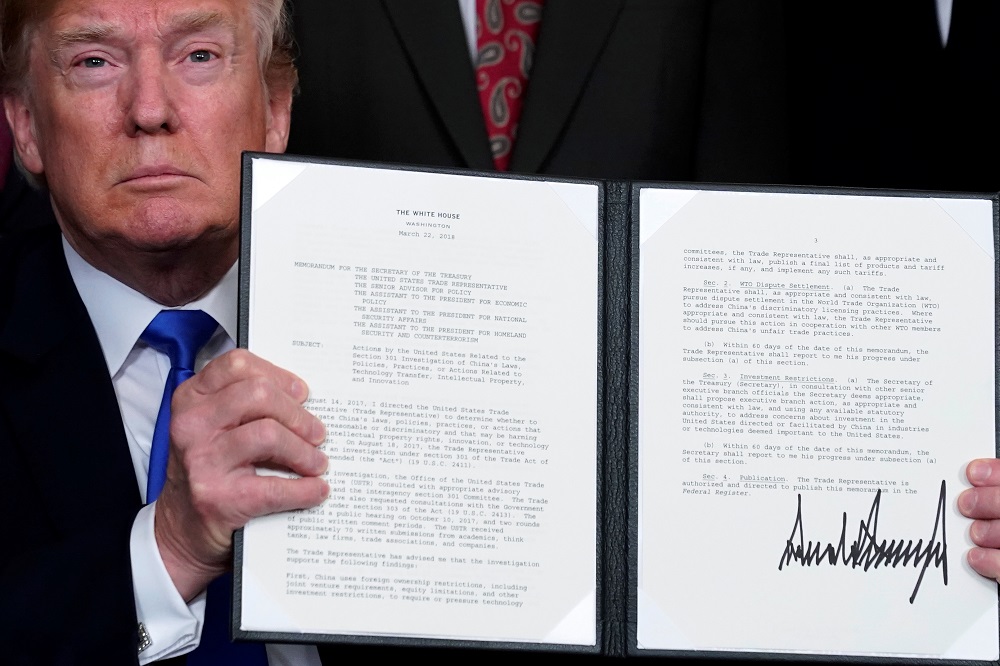

Trump’s Tariff Formula Is Still Wrong. Maybe That’s Why No One Will Admit They Created It.

Last Friday, we showed that the Trump Administration’s tariff formula contained an error that made its calculated tariffs up to four times too large. The entire premise of the administration’s…

April 4, 2025

President Trump’s Tariff Formula Makes No Economic Sense. It’s Also Based on an Error.

President Trump on Wednesday announced tariffs on practically every foreign country (and some non-countries), ranging from a 10 percent minimum all the way up to 50 percent. The economic fallout…

March 13, 2025

Two Charts Show Why a Trade War Over Fentanyl Doesn’t Make Sense

Following a month-long pause, President Trump last week reimposed tariffs on Canada and Mexico, only to pause many of them again two days later. Different reasons have been offered by…

February 28, 2025

Less Than Half of Medicaid Recipients Work Enough to Comply With a Work Requirement

Congress is considering implementing work requirements for Medicaid. This reform could help Congress achieve its goal of reducing federal expenditures and simultaneously strengthen the incentive for Medicaid recipients to work….

February 4, 2025

The Family First Act Would Expand Net Income Tax Refunds to Higher Income Families

Some pro-family conservatives are rallying around Rep. Blake Moore’s (R-UT) Family First Act. Relative to a clean extension of the Tax Cuts and Jobs Act, the bill would cost an additional $575 billion over the…

October 18, 2024

Pro-Marriage Conservatives Should Reject a Per-Child Phase-In of the Child Tax Credit

Earlier this week, scholars from the Ethics and Public Policy Center, the Niskanen Center, and other right-of-center organizations issued a memo calling for pro-family tax reforms during the upcoming debate over the…

April 9, 2024

The Child Tax Credit: My Long-Read Q&A with Kevin Corinth

The Child Tax Credit is a tax benefit available to many American families for the purpose of reducing their federal income tax liability. It’s specifically designed to help offset the cost of…

January 29, 2024

Per-Child Benefit in Wyden-Smith Child Tax Credit Bill Would Discourage Full-Time Work for Families with Multiple Children

The Wyden-Smith proposed tax legislation would make four changes to the Child Tax Credit (CTC). First, it would increase the cap on the refundable portion of the CTC, eventually to the same…