May 14, 2025

Graduation in the Time of COVID: The Weakened Relationship with Chronic Absenteeism

Key Points Read the full PDF. Read a brief with the research highlights. Executive Summary The COVID-19 pandemic and schools’ responses to it resulted in learning loss that reversed two decades of progress on student achievement and drove chronic absenteeism to unprecedented heights. Yet graduation rates did not fall over the same period— instead, they…

May 12, 2025

To Improve Student Outcomes, Focus On Classroom Practice, Not Policy

Last week, I had the privilege of delivering keynote remarks at Marquette University Law School’s Lubar Center for a conference focused on redirecting K-12 education reform toward classroom teaching. Inspired by my recent Marquette Today piece, the event—hosted in collaboration with the College of Education—brought together educators, researchers, and policymakers to discuss how improving classroom practice…

May 7, 2025

Displacement by Design: How Bad Policy Made Housing Scarce, and How We Can Fix It

Musical chairs is one of the first games we play as children. The rules are simple: there are fewer chairs than players. When the music stops, someone ends up standing. Not necessarily because they weren’t fast enough—but because the game was designed for someone to lose. Now imagine blaming the child for losing. We question…

May 7, 2025

Workforce Participation for Older Americans: Warning Lights Flashing

Over the past generation, the work trends for older Americans were one of the bright spots in an otherwise decidedly mixed labor force picture. But that is no longer the case. Both employment and labor force participation rates (LFPRs) for the 55-plus contingent in the American workforce fell sharply during the Covid-19 pandemic—but mysteriously, and…

May 7, 2025

Republicans Unveil Plan to Rein in Student Debt and Waste in Higher Education

In a significant development for higher education policy, House Republicans have unveiled a sweeping proposal to reform student loans and financial aid through the federal budget reconciliation process. This effort, which complements President Trump’s recent executive order on accreditation reform, signals a renewed push to rethink how the federal government supports students and holds institutions accountable for…

May 7, 2025

Did ‘China Shock’ Throw Millions of Americans Out of Work?

In a Wall Street Journal op-ed Monday, Treasury Secretary Scott Bessent claimed that “3.7 million Americans lost their jobs” due to the “China Shock”—the increased import competition occurring after China was granted membership in the World Trade Organization. He cites research by David Autor, David Dorn, and Gordon Hanson, linking to two of their papers. But it appears…

May 6, 2025

What DOGE Flagged as Unemployment Fraud Is Just the Tip of the Iceberg—Most of Which Will Never Be Recovered

The Department of Government Efficiency recently spotlighted unemployment benefits paid to tens of thousands of individuals whose reported birthdates indicated they were either children or dead. One claimant’s birthdate even suggested he or she hadn’t been born yet. As Elon Musk said, “Your tax dollars were going to pay fraudulent unemployment claims for fake people born in the future!” The $382 million DOGE identified that taxpayers lost on the associated improper payments is real money. But it’s also just…

May 5, 2025

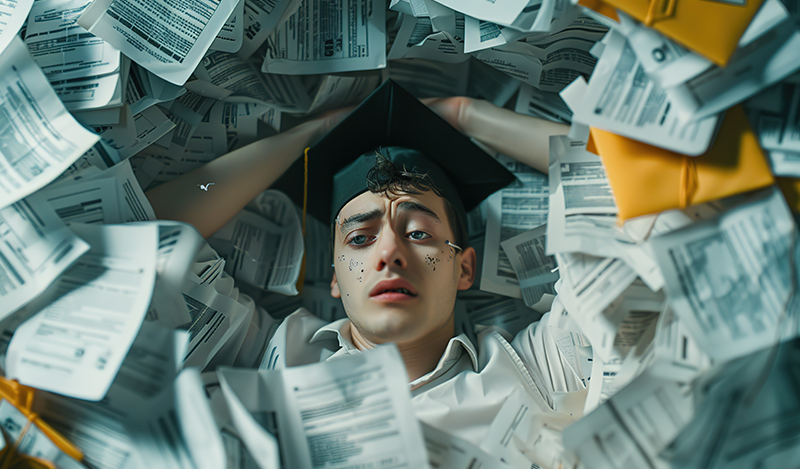

What’s in House Republicans’ Student Loan Overhaul

House Republicans have introduced a comprehensive student loan overhaul as part of the broader budget reconciliation process. Known as the “Student Success and Taxpayer Savings Plan,” the package of reforms aims to save hundreds of billions of dollars through new student loan limits, changes to the repayment system, and policies to hold colleges accountable for their outcomes. If enacted,…

April 30, 2025

The Student Loan Bubble Is about to Pop

At the outset of the covid-19 pandemic, federal student-loan borrowers won what appeared to be a reprieve. That five-year pause on payments and interest accumulation is now shaping up to be a curse in disguise. Last week, the Trump administration drew criticism for announcing that the Education Department would resume involuntary collections next month. But the squeeze…

April 28, 2025

You Autor Know

Along with many other controversial issues in 2025, Americans are at odds over the merits of tariffs. Underlying this debate is a more specific one—the impact of increased trade with China over the past 25 years on American manufacturing employment. Advocates of tariffs hope they will bring back blue-collar jobs, to which they ascribe special…