September 4, 2024

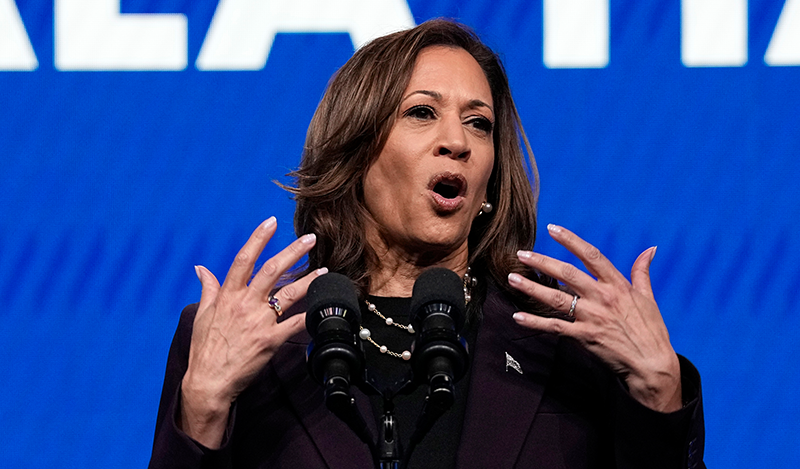

Kamala Harris’s Housing Plan Would Be Worse Than Doing Nothing

Originally appeared in Newsweek On August 16, presidential candidate Kamala Harris unveiled a series of housing proposals that recycle the same failed strategies that have plagued federal housing policy for decades. Among the key components are subsidies for the construction of 3 million new housing units over four years, as well as a total of $100 billion…

September 2, 2024

This Is How to Fix the Housing Crisis

Vice President Kamala Harris correctly identified one of America’s biggest problems when she said that “there’s a serious housing shortage.” America’s affordable-housing crisis exacerbates wealth inequities, leads low-income parents to live in neighborhoods with less upward mobility and reduces our country’s capacity for economic growth, innovation and adaptation to regional shocks. Unfortunately, her proposed solutions…

August 30, 2024

Harris’s Child Tax Credit Plan Punishes Working Families

Vice President Kamala Harris recently announced an economic plan for her presidential campaign. A centerpiece is the transformation of the Child Tax Credit (CTC) into a child allowance. If it became reality, the policy would discourage parental employment and risk harming the long-run prospects of children. These unintended consequences together with the plan’s cost should…

August 29, 2024

The Distribution of Social Capital across Individuals and its Relationship to Income

Abstract There have been several attempts to measure social capital—the value inhering in relationships—at an aggregate level, but researchers lack comprehensive individual-level social capital measures. Using a combination of direct linkage and imputation across several nationally representative datasets, we produce a comprehensive measure of social capital at the individual level. We validate our measure by…

August 28, 2024

Some Context Behind JD Vance’s Child Tax Credit Comments

Recently, GOP Vice Presidential nominee JD Vance said on Face the Nation “We should expand the child tax credit… I’d love to see a child tax credit that’s $5,000 per child.” He further proposed that the expanded credit be extended to “all American families,” emphasizing disparities in the availability of the current child tax credit…

August 24, 2024

Harris’s Child Tax Credit Proposal Could Backfire, Perpetuating Poverty

A centerpiece of Vice President Harris’ newly released economic plan is a revamped Child Tax Credit, which would send families $6,000 for each newborn and up to $3,600 for older children, up from the existing $2,000 per child credit. Her proposal follows Vice Presidential candidate J.D. Vance’s recent call to increase the credit to $5,000…

August 16, 2024

The Harris Campaign’s Foolish Down-Payment-Assistance Scheme

On the surface, Kamala Harris’s proposal to provide $25,000 in down-payment assistance to first-time homebuyers looks to be an incentive for upward mobility. Historically, homeownership has been the foundation for wealth creation for those of modest means. On closer inspection, however, down-payment assistance sends the wrong message — not only because already high home prices are likely to…

August 15, 2024

Kamala Harris Will Pay You Not to Work

A recent study confirms that universal basic income—no-strings-attached benefit checks offered to recipients regardless of need or contribution to the program—discourages work. That’s relevant to the presidential race. Kamala Harris has called more than once for paying UBI-like benefits. Participants in the UBI program worked nearly 1½ hours less a week on average, and unemployment rose. Other adults in…

August 6, 2024

Trump’s Tax Law Diminished Incentives for Charitable Giving, But We Can Fix It

Debate over the potential renewal of the so-called Trump tax cuts of 2017 will be building as their expiration approaches next year. The focus will likely be on corporate and personal tax rates. But there’s a less-appreciated but consequential side effect of the Tax Cuts and Jobs Act: its impact on charitable giving. Simply put,…

August 5, 2024

Are Opportunity Zones an Effective Place-Based Policy?

When Congress passed and President Trump signed into law the Tax Cuts and Jobs Act at the end of 2017, most attention centered on the reduction in the corporate tax rate and overhaul of the individual tax code. Few noticed a provision added at the last minute establishing a new place-based policy in the United…