Welcome to Our Research Archive

Search and filter by content type, issue area, author, and keyword

December 1, 2023

Red States Can Lead the Way on Marriage and Fatherhood

…encouraging all dads — resident and nonresident — to do a good job with their kids while also promoting the institution that maximizes the odds that men will live with…

November 14, 2023

Did Child Poverty Really Increase Last Year?

In 2021, Democrats succeeded in temporarily expanding the child tax credit (CTC) as part of President Biden’s American Rescue Plan. Previously, the maximum CTC of $2,000 per child was available only…

October 25, 2023

Dispelling Myths About The Child Tax Credit

…typical household today pays on average $709 more per month due to inflation than two years ago — far exceeding the maximum CTC for two children of $600 per month temporarily paid then. Even…

October 20, 2023

Value Needs to be the Next Buzzword in Higher Education

…with an eye to protecting people’s privacy. During lunch, Scott Pulsipher, president of Western Governors University (WGU), spoke about how WGU seeks to maximize the value of their programs, and…

October 11, 2023

CHANGING THE OFFICIAL POVERTY MEASURE WOULD HELP RICH STATES AND HURT POOR STATES

…example, the maximum income a family of four could have and still receive SNAP is currently just under $41,000 in every state except Alaska and Hawaii. The SNAP eligibility threshold…

October 5, 2023

Changing the Official Poverty Measure Would Help Rich States and Hurt Poor States

…Part D subsidies. For example, the maximum income a family of four could have and still receive SNAP is currently just under $41,000 in every state except Alaska and Hawaii….

September 18, 2023

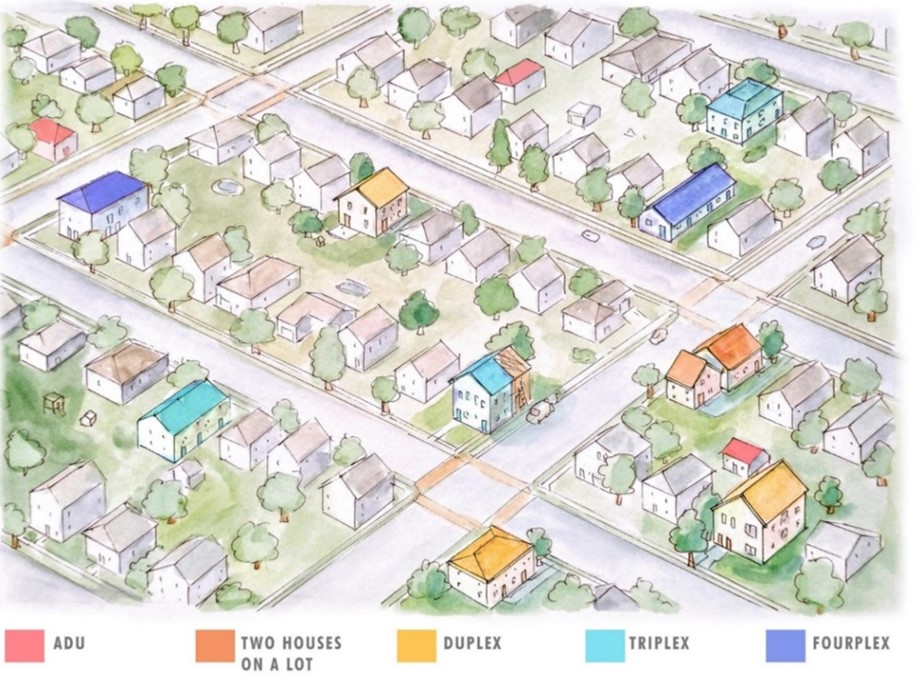

There’s an Easy Fix That Would Solve Our Housing Crisis: Light Touch Density

…country, an estimated 930,000 additional housing units could be created annually (depending on the maximum allowed density) over the next 30 to 40 years. This moderate density increase would expand…

August 10, 2023

The Real Reason People Leave Religion

…designed to maximize individual accomplishment as defined by professional and financial success. Such a system leaves precious little time or energy for forms of community that don’t contribute to one’s…

August 3, 2023

Expanding Economic Opportunities Through Evidence-Based Sector Training

…inequalities and improving employment outcomes more effectively. Responding to Hendra, Schaberg, and Orrell, the second report—Scaling Year Up to Maximize Access and Impact by Garrett A. R. Yursza Warfield—discusses Year Up,…

June 22, 2023

The Cost of Thriving Has Fallen: Correcting and Rejecting the American Compass Cost-of-Thriving Index

Abstract The Cost-of-Thriving Index (COTI), developed by American Compass Executive Director Oren Cass, asks whether families can afford a middle-class lifestyle. It compares the costs of five goods and services…