Welcome to Our Research Archive

Search and filter by content type, issue area, author, and keyword

- ✕ Clear Filter

- Angela Rachidi (5)

- Beth Akers (1)

- Brent Orrell (1)

- Bruce D. Meyer (2)

- Edward J. Pinto (1)

- Edward L. Glaeser (1)

- James Pethokoukis (3)

- Kevin Corinth (21)

- Matt Weidinger (7)

- Michael R. Strain (1)

- Richard Burkhauser (4)

- Robert Doar (1)

- Scott Winship (10)

- Stan Veuger (1)

- Timothy P. Carney (1)

- Tobias Peter (1)

- W. Bradford Wilcox (1)

- Yuval Levin (1)

April 4, 2025

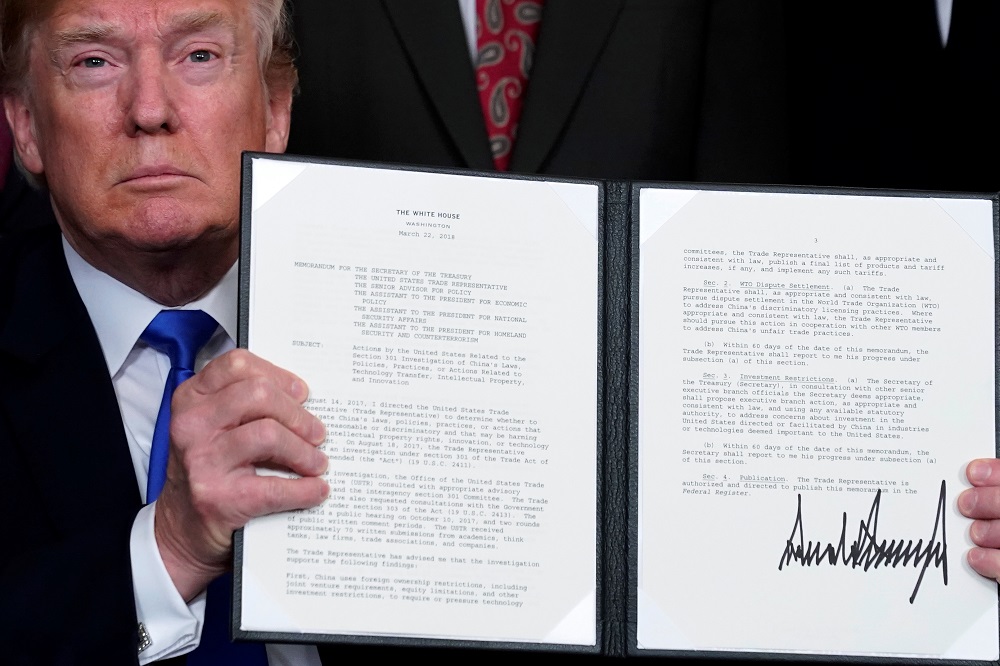

President Trump’s Tariff Formula Makes No Economic Sense. It’s Also Based on an Error.

President Trump on Wednesday announced tariffs on practically every foreign country (and some non-countries), ranging from a 10 percent minimum all the way up to 50 percent. The economic fallout…

March 18, 2025

Poorly Defined: Reforming the Poverty Line | POLICY LENS

…but measuring the magnitude of that success is not so straight forward. AEI’s Kevin Corinth explains that defining poverty is largely a decision of society, rather than of science, and…

March 13, 2025

Two Charts Show Why a Trade War Over Fentanyl Doesn’t Make Sense

Following a month-long pause, President Trump last week reimposed tariffs on Canada and Mexico, only to pause many of them again two days later. Different reasons have been offered by…

March 11, 2025

An Evaluation of Cost Saving Reforms of the Supplemental Nutrition Assistance Program

…eliminating the standard deduction and broad based categorical eligibility—can balance the goals of targeting and strengthening work incentives. Corinth_An Evaluation of Cost Saving Reforms of the Supplemental Nutrition Assistance Program…

February 28, 2025

Less Than Half of Medicaid Recipients Work Enough to Comply With a Work Requirement

Congress is considering implementing work requirements for Medicaid. This reform could help Congress achieve its goal of reducing federal expenditures and simultaneously strengthen the incentive for Medicaid recipients to work….

February 18, 2025

Family-Friendly Policies for the 119th Congress

Key Points American birth rates have hit record lows, but Americans still say they want children. Family formation seems unattainable to many parents. There is no single federal policy that…

February 4, 2025

The Family First Act Would Expand Net Income Tax Refunds to Higher Income Families

Some pro-family conservatives are rallying around Rep. Blake Moore’s (R-UT) Family First Act. Relative to a clean extension of the Tax Cuts and Jobs Act, the bill would cost an additional $575 billion over the…

January 24, 2025

The Targeting of Place-Based Policies: The New Markets Tax Credit Versus Opportunity Zones

Abstract For a place-based policy to succeed, it must target the right areas—typically those with lower economic development and resident well-being. The U.S. has two major place-based tax policies: the…

January 21, 2025

President Trump’s USDA Should Fix Food Stamp Work Requirement Waivers

…during those times. Source: Richard V. Burkhauser, Kevin Corinth, Thomas O’Rourke, and Angela Rachidi, “Coverage, Counter-Cyclicality and Targeting of Work Requirement Waivers in the Supplemental Nutrition Assistance Program,” Working Paper…

January 17, 2025

Reforming Work Requirement Waivers in SNAP

Download PDF Reforming Work Requirement Waivers One-PagerDownload…