September 4, 2024

Kamala Harris’s Housing Plan Would Be Worse Than Doing Nothing

Originally appeared in Newsweek On August 16, presidential candidate Kamala Harris unveiled a series of housing proposals that recycle the same failed strategies that have plagued federal housing policy for decades. Among the key components are subsidies for the construction of 3 million new housing units over four years, as well as a total of $100 billion…

May 7, 2024

How Zoning Policies Affect the Housing Supply: City of Denver Case Study

Summary:The City of Denver switched to a new zoning code in June 2010. Most areas were upzoned, but some were downzoned. Overall, the policy encouraged housing construction in Denver. Slide deck

March 27, 2024

Market-oriented Reform Principles and Policies that Would Help the Housing Market

Introduction: In this election year, Congress and the President are feeling the urge to help Americans affected by rising housing affordability pressures across the country. With the status-quo untenable, Congress and the President are itching to address housing affordability, availability, and other community needs. Before springing into action, our leaders need to first establish clear…

February 22, 2024

The Workforce/Middle-Income Housing Tax Credit

A recording of the event will be uploaded soon. Event Summary Congress is considering expanding the Low-Income Housing Tax Credit (LIHTC) and creating a new Workforce or Middle-Income Housing Tax Credit (MIHTC). In response, the AEI Housing Center gathered leading housing experts to discuss the LIHTC’s poor record and propose more effective market solutions. In…

January 17, 2024

Congress, Don’t Legislate a Takeover of the Nation’s Rental Housing Market

It is an election year and Congress will soon consider two bipartisan bills to address high rental costs for many renters. The first is the Workforce Housing Tax Credit (WFHTC) and the second would be an expansion of the existing Low-Income Housing Tax Credit (LIHTC). The WFHTC would extend eligibility for subsidized units tenants earning below the area median….

October 20, 2023

Revenge of the Rust Belt: The Surprising Forces That Have Made the Midwest the Hottest Housing Market Around

In the Fortune article below Shawn Tully discusses the resurgence of the Midwest’s housing market with Ed Pinto, the Director of AEI’s Housing Center. According to American Enterprise Institute data, eight of the nine cities achieving the highest appreciation in housing prices for the 12 months ended Aug. 31 hail from the Midwest. In the pandemic-driven housing…

September 18, 2023

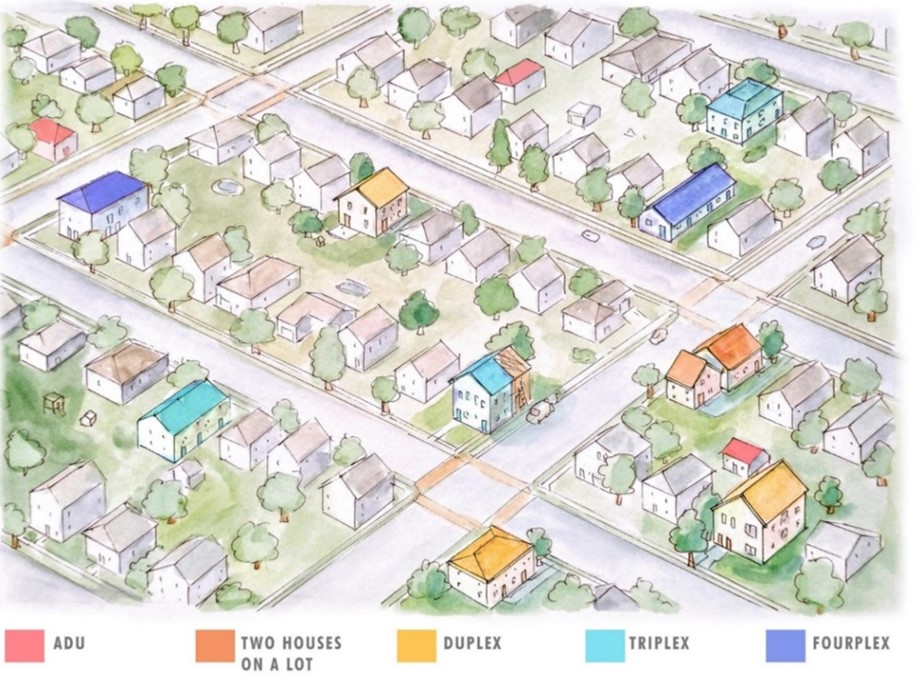

There’s an Easy Fix That Would Solve Our Housing Crisis: Light Touch Density

We’re living through one of the greatest housing crunches the U.S. has ever known. It’s resulted in record numbers of homelessness and entire generations certain they will never become homeowners, that critical milestone of the middle class. But there is a simple solution to the problem. The answer to our housing crisis is to legalize…

May 23, 2023

Biden Courts Another Mortgage Crisis

The Biden administration is making moves that could imperil the safety of the housing finance system. Recent mortgage pricing changes, which have generally decreased fees for borrowers with lower credit scores and increased fees for those with higher scores, have rightly garnered public outcry, but they are the tip of the iceberg. The administration’s other…