Welcome to Our Research Archive

Search and filter by content type, issue area, author, and keyword

- ✕ Clear Filter

- Brent Orrell (1)

- Howard Husock (2)

- Ian Rowe (1)

- James Pethokoukis (1)

- Kevin Corinth (2)

- Matt Weidinger (5)

- Matthew Continetti (1)

- Michael R. Strain (16)

- Naomi Schaefer Riley (1)

- Paul Ryan (1)

- R. Glenn Hubbard (2)

- Ramesh Ponnuru (1)

- Robert Cherry (1)

- Ross Douthat (2)

- Ryan Streeter (1)

- Scott Winship (7)

- Timothy P. Carney (1)

- W. Bradford Wilcox (1)

June 5, 2025

The One Thing Both Parties Agree On: More Deficits and Debt

The House of Representatives recently passed by a single vote Republicans’ “One Big Beautiful Bill” that reflects President Donald Trump’s tax and spending agenda, and GOP senators are now working to put their own stamp on the bill. Given that partisan pedigree, you would think this bill had little in common with legislation that Democrats crafted during the…

May 7, 2025

Did ‘China Shock’ Throw Millions of Americans Out of Work?

In a Wall Street Journal op-ed Monday, Treasury Secretary Scott Bessent claimed that “3.7 million Americans lost their jobs” due to the “China Shock”—the increased import competition occurring after China was granted membership in the World Trade Organization. He cites research by David Autor, David Dorn, and Gordon Hanson, linking to two of their papers. But it appears…

April 24, 2025

Musk’s High-Tech Polygamy Is a Dead End

Elon Musk told a conference in Saudi Arabia last year that his listeners “should view the birthrate as the single biggest problem [we] need to solve. If you don’t make new humans, there’s no humanity, and all the policies in the world don’t matter.” In this way, he spotlighted his commitment to the pronatalist cause—the idea that…

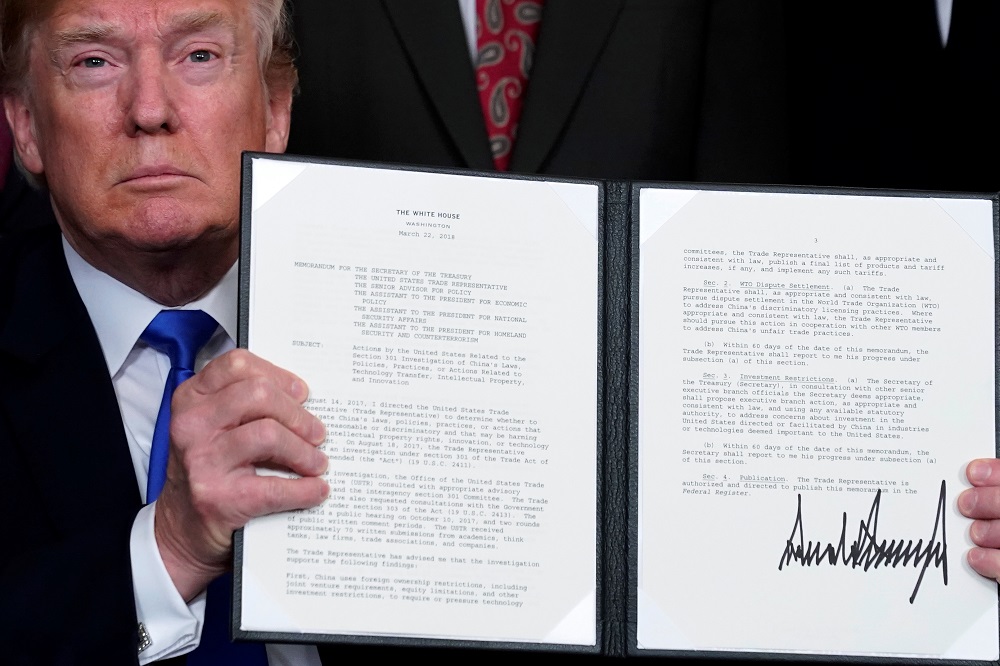

April 3, 2025

Trump’s Tariffs Are a Historic Tax Hike

If implemented, the tariffs announced yesterday by President Trump would constitute the largest tax increase since the 1968 levies to fund the Vietnam War. The details will matter, but my back-of-the-envelope calculation suggests that the tariffs — which are taxes on imported goods — could be as large as 2 percent of annual GDP. This tax increase…

February 20, 2025

The American Dream Is Not a Coin Flip, and Wages Have Not Stagnated

In my last column, I showed that Americans’ assessments of the economy have tracked the official unemployment rate well over the long run. That is important because it suggests that both public opinion and objective measures indicate that the labor market is historically strong (though accelerating inflation during and after the COVID-19 pandemic has caused these…

January 22, 2025

How the Trump Administration Can Hit Its Growth Target

By setting an ambitious 3% growth target, US Treasury Secretary nominee Scott Bessent has provided the Trump administration a North Star to follow in devising its economic policies. The task now is to focus on productivity growth and avoiding any unforced errors that would threaten output. US Treasury Secretary nominee Scott Bessent is right to…

January 16, 2025

Should We Believe the Economic Data or Americans’ “Lyin’” Eyes? The Answer Is Yes.

Many Americans are convinced the economy is ailing and that life is financially tougher today than a decade—or a generation—ago. Social media posts wax nostalgic for a long-lost era when all single breadwinners allegedly could afford a home and two cars for a family of four. Everyone seemingly knows someone who did everything they were…

December 20, 2024

Fixing Inflation, Right-Sizing the Federal Government

Thirty years ago next month, Federal Reserve Board Chairman Alan Greenspan testified before a joint session of the House and Senate Budget Committees with talk of deficit reduction in the air. In January 1995, Republicans had just won control of both houses for the first time in 42 years. The federal debt had reached 48…

December 17, 2024

Industrial Policy and Deficits: Dark Clouds for Democratic Capitalism

Democratic capitalism is a system that marries liberal democracy and free-market capitalism. This union creates tensions, and requires balancing competing aims. But this tension is healthy, not destructive — provided that democracy and capitalism are properly balanced, each sphere reinforces the other. Over the long term, capitalism requires liberal politics; and democracy will not maintain…

December 5, 2024

Inflation Reduction Act Offers a General Lesson against Industrial Policy

With President Trump’s stunning return to power, Congress has the opportunity in 2025 to enact additional business tax cuts. One of their specific goals should be to make “full expensing” of business investment a permanent part of the tax code. By allowing businesses to deduct the full cost of investment in the year the spending…