October 25, 2023

Dispelling Myths About The Child Tax Credit

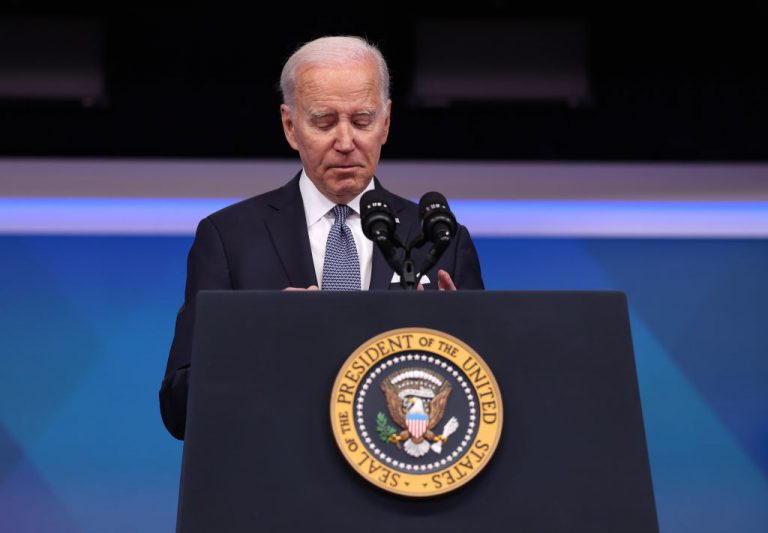

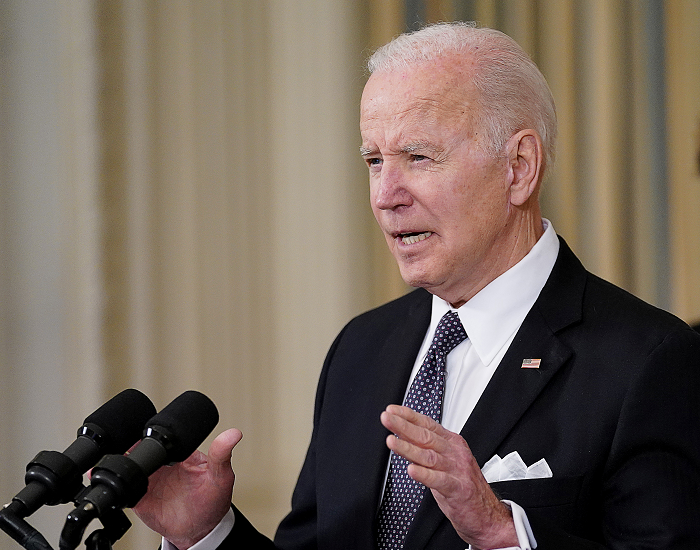

Every culture has its famous myths, such as Bigfoot and the Loch Ness monster, and the world of politics is no different. Take, for example, President Joe Biden’s claims that he is a unifier or that ” Bidenomics” is working . The president offered another mythical claim last month when he said that “we cut child poverty by nearly half ……

October 23, 2023

A Carbon Tax to Finance Child Tax Credit Expansion

A carbon tax is considered by most economists to be the most efficient and effective way to reduce carbon emissions. However, a long-standing political challenge to a carbon tax is the perception that it would disproportionately burden low- and middle-income households relative to high-income households. Many analysts and lawmakers have proposed using carbon tax revenues…

August 14, 2023

Tracking Plans to Make Pandemic Benefit Expansions Permanent

In 2008, former White House Chief of Staff and Chicago Mayor Rahm Emanuel famously said what has come to be known as Rahm’s rule: “You never want a serious crisis to go to waste. And what I mean by that [is] it’s an opportunity to do things that you think you could not do before.” It’s clear that…

August 9, 2023

The CTC Work Incentive Works

The expiration of the American Rescue Plan Act at the end of 2021 brought with it the end of the fully refundable Child Tax Credit (CTC). The CTC has since returned to its pre-pandemic form, phasing-in at 15 percent of earnings beyond $2,500, up to a maximum of $1,600 in a refundable CTC per child…

July 17, 2023

Testimony: The Child Tax Credit: 25 Years Later

Chairman Bennet, Ranking Member Thune, and subcommittee members, thank you for theopportunity to testify. My name is Angela Rachidi and I am a Senior Fellow on poverty andopportunity at the American Enterprise Institute. Before I joined AEI, I was a DeputyCommissioner for the New York City Department of Social Services, where for more than a…

July 17, 2023

Testimony: Correcting the Record on the Effects of Replacing the Child Tax Credit with a Child Allowance

Chairman Bennet, Ranking Member Thune, and distinguished members of the Subcommittee onTaxation and IRS Oversight, thank you for the opportunity to testify on the Child Tax Credit(CTC). My name is Kevin Corinth, and I am a Senior Fellow and the Deputy Director of theCenter on Opportunity and Social Mobility at the American Enterprise Institute. This…

July 10, 2023

Reforming the EITC to Reduce Single Parenthood and Ease Work-Family Balance

Sixty years ago, in 1963, 94% of American children were born to married mothers. Today, the figure is only 60 percent. This decline signals a fundamental disruption in the long-standing stability of the traditional family, the foremost institution shaping each generation of children. Using the Census Bureau’s American Community Survey, I find that in 2021, 40% of…

June 30, 2023

Democrats Call Biden’s Economy “Savage” in Attempt to Revive Child Tax Credit

With unemployment near record lows and President Joe Biden running for reelection, some Democrats recently offered an unexpected take on the U.S. economy: It stinks, especially for low-income families. During a recent Senate Finance Committee hearing, Sen. Michael Bennet (D-CO) thundered that parents are currently “scraping by … in this savage economy,” burdened with “some of the lowest…

May 4, 2023

Work Is Essential to the American Dream

Work is one of the foundations of American life. Almost always, being employed and earning income gives individuals the opportunity, responsibility, and community they need to flourish. The broader importance of work can’t be overstated. A larger workforce also contributes significantly to our general prosperity allowing us to afford, among other things, a more effective…