At their best, safety net policies in the US reduce poverty by spurring upward mobility among the most disadvantaged. This requires identifying disadvantaged families and scaling benefits according to their need, all while trying to encourage employment and other mobility-inducing behaviors in the process. When safety net programs do not meet this charge, families can face challenging trade-offs about whether to work or continue receiving benefits.

Oftentimes, this happens when households face a steep decline (or complete loss) in benefits after earning beyond a certain amount—also known as facing a “benefit cliff.” A recent report from Erik Randolph of the Georgia Center on Opportunity highlights just how these dynamics work in the nation’s largest food assistance program, the Supplemental Nutrition Assistance Program (SNAP). Randolph’s analysis documents large benefit cliffs faced by many SNAP households, requiring participants to increase hours or wages by substantial (and often unrealistic) amounts to overcome the loss of benefits. His findings should point policymakers toward several necessary SNAP reforms.

SNAP is one of the country’s largest safety net programs, providing over $107 billion in benefits to low-income households per year. SNAP can only be used to purchase food products, and is intended to provide nutritional support to low-income families. As with many safety net programs, SNAP benefit amounts phase out as household earnings increase. Households with no income receive the maximum benefit—$766 per month for a family of three—but for each additional dollar that a household earns, SNAP benefits are supposed to decline by 30 cents until they phase out slowly to $0.

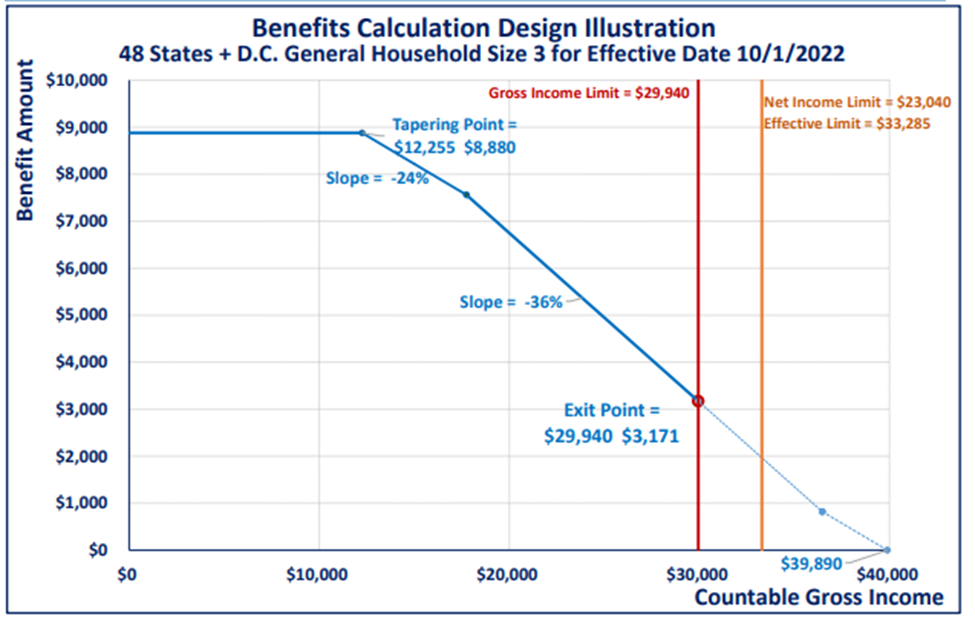

In practice, however, few SNAP households experience this gradual reduction of benefits. SNAP permits households to take a variety of income deductions and maintains a benefit cutoff when their income exceeds a certain amount. Together, these factors disrupt the gradual phase out, instead imposing a steep benefit cliff. Randolph describes these mechanics in detail, explaining that there is a tapering point where benefits start to decline, a rate by which benefits decline, and an exit point where benefits are $0. However, according to Randolph, these points “are grossly misaligned, causing benefit losses at exit that cannot be overcome with a typical pay raise.”

This misalignment happens because once a household is already determined SNAP eligible, they are permitted deductions that lower their net household income for the purposes of calculating their SNAP benefit amount (i.e., the lower the household’s net income, the higher the SNAP benefit). These deductions include a standard deduction ($198 for a family of three), earnings deduction (20 percent of earnings), dependent care deduction (no limit), child support deduction (no limit), medical expense deduction (no limit), and excess shelter deduction (equal to a households’ housing costs beyond half of their net income after all other deductions). Virtually all of these deductions vary from household to household, meaning that SNAP recipients face different “tapering points,” or the points at which their benefits begin to decline.

As Randolph shows in his analysis, the ability of SNAP households to claim these deductions can lead to recipients facing an abrupt end to their SNAP eligibility due to their income level. This is because SNAP has a gross (total income) and net (income after deductions) income limit, meaning that households with incomes greater than 130 percent of the federal poverty line (FPL) (or net income greater than 100 percent of the FPL) are not eligible for SNAP. Because of the deductions used to determine income for the purposes of calculating benefit amounts for eligible households, many SNAP households receive relatively high benefit amounts until their gross (or net) income reaches the limit. Once SNAP households reach the income eligibility limit, they face an abrupt drop in benefits. Figure 1 illustrates the cliff for a family of three in 2022.

Figure 1. SNAP Benefits by Household Income for a Family of Three, 2022.

Source: Erik Randolph, Georgia Center for Opportunity, “Solving the Food Assistance (SNAP) Benefit Cliffs, Fixing the Safety Net System”, October 4, 2023.

Note: This calculation only pertains to households without an elderly or disabled member, assumes annual shelter costs of $13,428, and assumes that all income comes from earnings.

As illustrated in Figure 1, as household income approaches the gross income limit (in this case $29,940 per year), the household faces a steep benefit cliff. For example, a hypothetical household with $29,930 gross income would receive nearly $3,200 in SNAP benefits per year due to various deductions allowed when calculating the benefit amount. However, if this hypothetical household had just $11 more in gross income they would no longer be eligible for SNAP and would lose their entire $3,200 SNAP benefit. This means that this SNAP-receiving household would need at least a $3,200 raise in order to overcome this cliff. In fact, the households’ pay raise would need to be even more than $3,200 to cover payroll and income taxes. And as Randolph points out, even if the household were to get a pay raise that fully offset their loss of benefits, why would they take that deal? As Randolph’s analysis shows, households would need a shockingly large increase in income to forgo thousands of dollars of food assistance they would lose.

Table 1 summarizes Randolph’s calculations showing the pay raises that households of various sizes would need to overcome these benefits cliffs. A single-person household receiving SNAP would need a 47 percent pay raise—increasing their annual income from $17,676 to $25,956—in order to offset the loss of their nearly $2,100 benefit. SNAP recipients with children face an even steeper benefit cliff. A family of three would need a 62 percent pay raise, or household income increasing from $29,940 to $48,480 to fully offset its lost SNAP benefit.

Table 1. Income, Benefits, and Pay Raises Necessary to Overcome Benefit Cliffs for SNAP Households of Various Sizes, 2022.

Source: Erik Randolph, Georgia Center for Opportunity, “Solving the Food Assistance (SNAP) Benefit Cliffs, Fixing the Safety Net System”, October 4, 2023.

Note: This calculation assumes that the household does not include an elderly or disabled member. It also assumes that a households’ shelter costs accord with Fair Market Rents established by the US Department of Housing and Urban Development, and that they take no other expense deductions. Additionally, it assumes that all income comes from earnings, and assumes an Earnings Loss Rate of 25 percent.

It is worth noting, however, that benefit cliffs are much smaller for households that contain a disabled or elderly member. Still, a household with a single disabled or elderly member would need a pay raise of 4.2 percent, and a three-person household with at least one elderly or disabled member would need a pay raise of 19.3 percent.

It goes without saying that most of the households facing these benefits cliffs do not have the opportunity to increase their annual income by tens of thousands of dollars, let alone a few thousand. Therefore, as a SNAP household approaches the benefit cliff, they face a significant employment disincentive. By working a few extra hours or taking a higher paying job, SNAP recipients could stand to lose thousands of dollars per year. In other words, a pay raise or promotion could make these households materially worse off, fundamentally undermining the program’s purpose.

The results from Randolph’s analysis should be alarming enough, but even more concerning is that federal policymakers have made benefit cliffs worse in recent years. One of the most consequential changes involved a review of the Thrifty Food Plan (TFP) in 2021, which raised benefit levels by 21 percent on average but did not adjust the gross (or net) income eligibility limit. The TFP measures the cost of an affordable, nutritious diet, and the Food and Nutrition Service (FNS) uses it to set SNAP benefit levels. Although Congress in the 2018 Farm Bill authorized a reevaluation of the TFP, historically, the FNS conducted the reevaluation in a cost-neutral way. Breaking with this precedent, the nonpartisan Government Accountability Office found that the USDA improperly implemented these changes, failing to provide adequate evidence to justify their changes.

Nevertheless, the reevaluation of the TFP significantly increased SNAP benefits. But because the phase out rate and income limits remained the same, benefit levels are higher at the exit point, thus increasing the amount of the benefit cliff for all households. As noted, historically, TFP reevaluations occurred in a cost neutral way avoiding the problem of making benefit cliffs worse. However, the FNS broke this precedent in the 2021 reevaluation and made benefits cliffs and SNAP’s work disincentives worse.

Randolph offers a number of policy recommendations to address the problems he discovered. But essentially the answer lies in better aligning SNAP’s tapering point, benefit reduction rate, and exit point. One way to accomplish this is setting the gross and net income limits to match the cost of an appropriately evaluated Thrifty Food Plan and working backwards using a standard benefit reduction rate and tapering point, limiting the use of deductions that misalign these points.

Safety net programs such as SNAP are designed to provide low-income Americans financial assistance to help them reach self-sufficiency and achieve upward mobility. However, when low-income households face steep benefit cliffs, as they often do in SNAP, they can face a significant disincentive to work and escape poverty. Such benefits cliffs fundamentally undermine the purpose of our safety net programs. Policymakers must work to eliminate such perverse incentives.