Welcome to Our Research Archive

Search and filter by content type, issue area, author, and keyword

March 17, 2025

How State Policymakers Can Save the Nuclear Family

…falling prospects of family life across the country, state policymakers need to take three steps. First, they should promote marriage (one of the biggest predictors of family formation) in public…

March 14, 2025

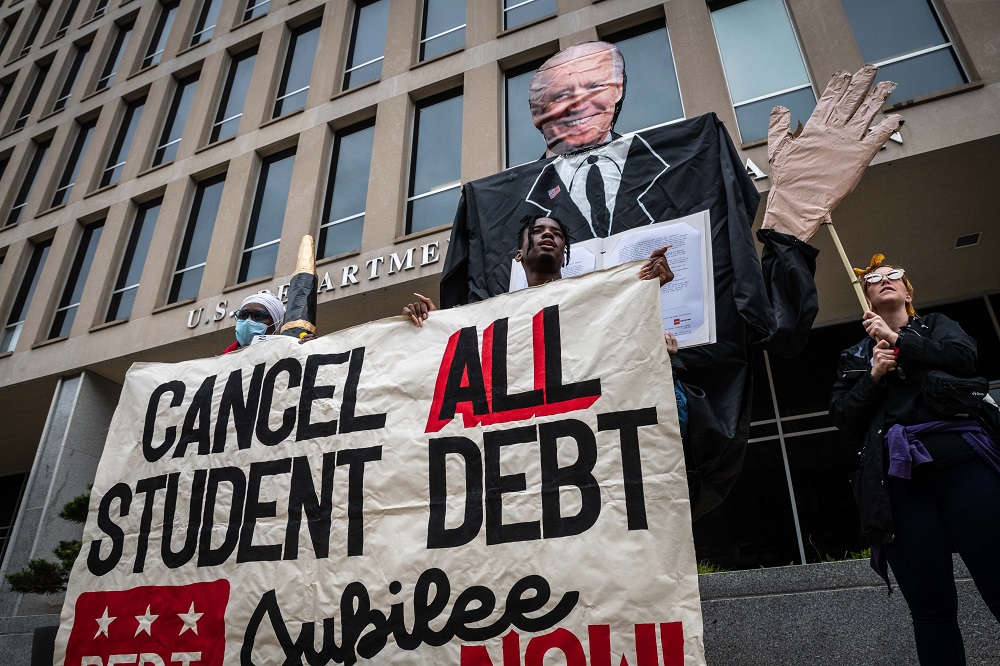

A Historic Opportunity for Higher Education Reform

…policy divides between mainstream Democrats and Republicans used to be trivial. For example, 10 years ago, Sen. Elizabeth Warren’s (D-Mass.) proposal to lower student loan interest rates to 3.9 percent seemed radical. It was…

March 11, 2025

The American Dream in Ohio depends on stronger Buckeye families

…The challenge, then, facing Ohio leaders is to take steps to strengthen marriage and family life across the state. Policymakers should ask public schools to teach the Success Sequence(which underlines the…

February 14, 2025

Poverty During the Pandemic and the Role of Government Transfers

…that pandemic-era policies played an important role in maintaining economic wellbeing during this period. Policymakers have long debated how best to alleviate child poverty and what role government support should…

February 4, 2025

Snip, Snip: Spending Cuts Are Coming

…circulated a short list of would-be savings totaling over $5 trillion, followed by a 50-page menu offering almost $15 trillion in nominal deficit reduction alongside more than $3 trillion in potential “sweeteners.” If lawmakers…

January 22, 2025

How the Trump Administration Can Hit Its Growth Target

…recognizing that some policy shifts that increase output might adversely affect other areas of social interest (such as the distribution of income) or even national security, policymakers should focus squarely…

January 7, 2025

Tax Policy Should Prioritize Shoring Up the Family

…have kids and rely on a sole breadwinner were thwarted by objections that a child allowance would also promote single-parent families in which no one worked. Policymakers seeking to use…

January 2, 2025

AI Will Have a Major Impact on Labor Markets. Here’s How the US Can Prepare

…the nation’s analytic systems and reports are not geared to produce the forward-looking “headlight” measures decision-makers need to navigate ambiguous, rapidly evolving technological change. Federal statistical data usually tell us…

December 27, 2024

DOGE Can Drive Reforms in America’s Broken Safety Net Programs

…poverty. But reform could be on the horizon, led by the new Department of Government Efficiency (DOGE). DOGE can address these staggering failures by identifying how lawmakers can streamline programs…

December 20, 2024

Fixing Inflation, Right-Sizing the Federal Government

…(GDP)—a level not seen since 1958. When the 119th Congress and the second presidency of Donald Trump begin next month, policymakers will face a much more daunting fiscal crisis. Federal…