Today’s US jobs report finds the nation’s unemployment rate increased to 4.3 percent in July. According to a measure often cited by liberal policymakers, that suggests the US has entered a recession, undercutting President Biden’s boast just last week that the US has “the strongest economy in the world.” That grinding contradiction is only reinforced by multiple Democratic bills that suggest current unemployment conditions should immediately trigger the payment of significant anti-recession stimulus benefits.

As the Washington Post’s Heather Long noted today, July’s unemployment rate increase suggests the US “could be in the early stages of a recession:”

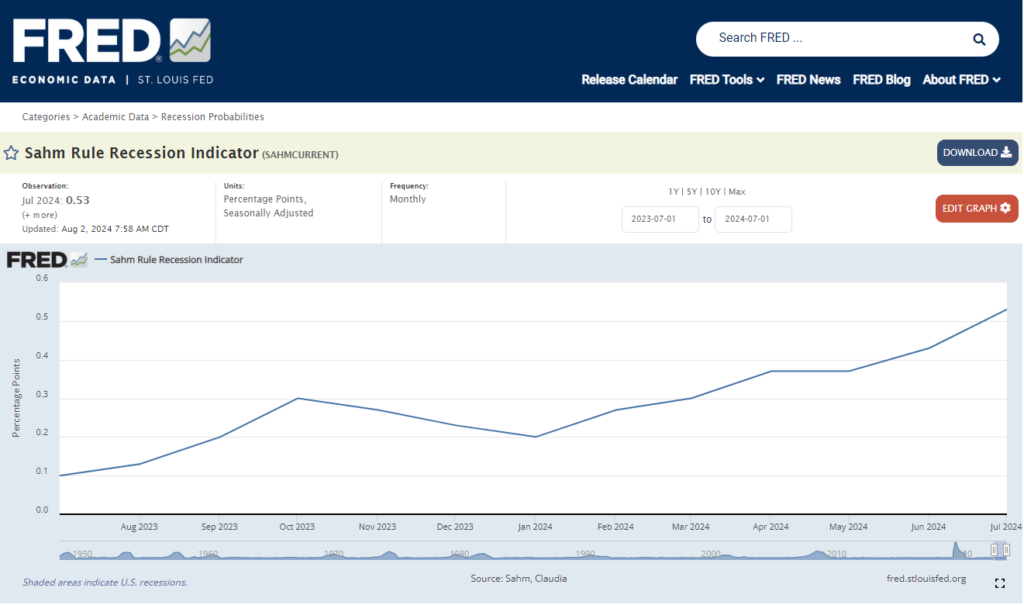

Long cites a recession-forecasting rule named after former Federal Reserve economist Claudia Sahm. According to the Federal Reserve Bank of St. Louis, the Sahm rule “signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months.” With July’s unemployment rate increase, the Sahm rule reached 0.53, eclipsing the 0.50 threshold signaling the start of a recession:

Source: Sahm Rule Recession Indicator (SAHMCURRENT) | FRED | St. Louis Fed (stlouisfed.org)

Despite those figures, just today Sahm cast doubt on her rule, stating that she is “confident that we are not in a recession.” That reinforces qualifications Sahm raised in a November 2023 op-ed (“Why My Recession Rule Could Go Wrong this Time”), which noted that growing numbers of “immigrants on work visas…entering the country” could be one factor behind rising unemployment. That qualifier doesn’t provide much political cover, since in 2021 President Biden tapped Vice President Harris to lead the administration’s efforts “stemming the migration to our southern border.”

But regardless of whether the US is technically in a recession, a series of liberal proposals citing the Sahm rule make it difficult for Democrats to shrug off growing concerns about the economy.

For the past decade, left-leaning policymakers have wrung their hands over what they regard as too few federal unemployment and other stimulus benefits paid during the Great Recession. In 2019, the Brookings Institution published a tome titled Recession Ready, which summarized those concerns and proposed replacing Congress’ discretion over when such benefits are paid with the Sahm rule and other “triggers”—measures that would automatically start and continue such benefits whenever unemployment rates are elevated. According to the authors of Recession Ready, whenever the Sahm rule threshold is reached, the federal government should automatically start providing large stimulus checks, enhanced infrastructure spending, and food stamp benefit increases.

Democratic lawmakers have taken up that theme, introducing a series of House and Senate bills automating the provision of enhanced federal funding for tuition-free community college and tuition-free state university education, all governed by the Sahm rule. And last fall Senate Finance Committee Chairman Ron Wyden (D-OR), accompanied by Bernie Sanders (I-VT), Elizabeth Warren (D-MA), Michael Bennet (D-CO), and Sherrod Brown (D-OH), introduced the Unemployment Insurance Modernization and Recession Readiness Act. A summary of that legislation’s “recession readiness” policies notes they would automatically trigger federal extended unemployment checks “during economic downturns”—defined by the Sahm rule.

Those bills are part of a broader effort by the political left to automate still more expensive benefits that, in prior recessions, depended on the enactment of temporary stimulus laws. Claudia Sahm noted in March that the goal of her rule is to “automatically send out stimulus checks as early as possible” in recessions. She highlighted the broader agenda in a 2021 New York Times op-ed aptly titled “Put the Money Printer on Autopilot.” Then-Sen. Kamala Harris in 2020 proposed an extreme version of that effort in legislation paying $2,000-per-month stimulus checks to most Americans throughout the pandemic, at an astonishing $21 trillion cost.

Democrats’ automatic stimulus legislation cites the Sahm rule without qualification, only reinforcing the widening gulf between their “strongest economy in the world” messaging and policy proposals designed to immediately expand federal largesse. That begs an obvious question: How can the US economy be the “strongest in the world” while at the same time meriting the automatic payment of billions of dollars in federal stimulus benefits?