August 7, 2024

A Bipartisan Solution to the Child Tax Credit Impasse

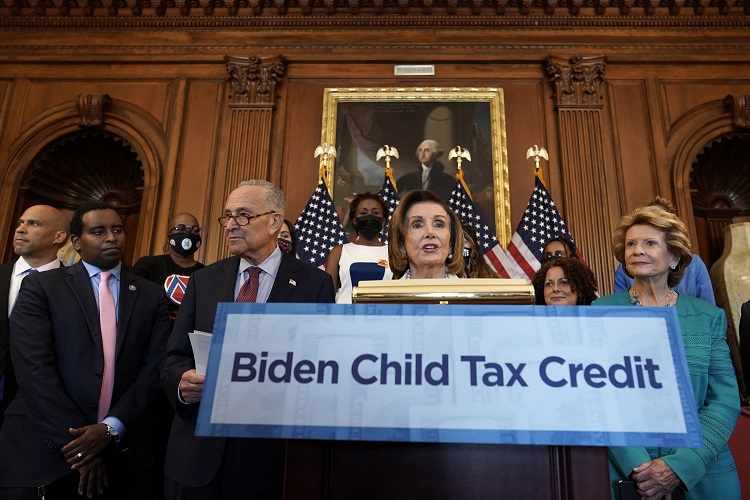

Last week, the Senate rejected a child tax credit revision that had bipartisan House support. It would have enabled more of the credit to be refundable to families with no employment income. Republican senators voted against it because they believed that providing unconstrained income to poor households would reduce their work effort. This was one of…

August 2, 2024

Democrats’ Automatic Stimulus Proposals Undermine the Administration’s “Strongest Economy” Claims

Today’s US jobs report finds the nation’s unemployment rate increased to 4.3 percent in July. According to a measure often cited by liberal policymakers, that suggests the US has entered a recession, undercutting President Biden’s boast just last week that the US has “the strongest economy in the world.” That grinding contradiction is only reinforced…

July 29, 2024

The Real Impact of Zoning and Land Use Reforms Contrary to the Urban Institute’s Claims

Not in my backyard (NIMBY) adherents across the country are beginning to weaponize a recent Urban Institute study that reviewed 180 zoning reforms and concluded these reforms barely affected the housing supply. Given Urban’s wide distribution and the paper’s seemingly comprehensive approach, coupled with the eagerness of NIMBYs to exploit such research, housing supply advocates need to be aware…

July 17, 2024

Key Takeaways from a New Report on Potential Unemployment Insurance Reforms

Yesterday, the National Academy of Social Insurance (NASI) released the final report of its Unemployment Insurance (UI) Task Force, of which I am a member. The task force was created in December 2020, as state UI agencies were besieged by record pandemic benefit claims and unprecedented fraud. I was one of several members added in late 2023. The purpose…

July 15, 2024

It Is Time to Set Goals for Cutting Chronic Absenteeism

Believe it or not, the 2024–25 school year will begin in some parts of the country in less than a month, and students will return to school. Whether they return to school consistently is the most important question at the opening of this school year. Whether schools, districts, and states make chronic absenteeism their top…

June 27, 2024

New Legal Roadblocks for Biden’s Student Loan Forgiveness Crusade

Last fall President Biden announced his “Plan B” for student loan cancellation after the Supreme Court ruled his initial efforts unconstitutional. Plan B, named the Saving on a Valuable Education (SAVE) Plan, was an attempt to eliminate the burden of student loans by lessening how much borrowers needed to repay. But this wasn’t in the spirit of…

June 17, 2024

Fixing the Roof on Sunny Days—and Other Lessons in Administering Unemployment Benefits

A recent hearing of the House Ways and Means Subcommittee on Work and Welfare confirmed that the financing of the nation’s Unemployment Insurance (UI) system is enormously complicated. Even the name of the federal payroll tax (FUTA—short for the Federal Unemployment Tax Act that authorizes it and pronounced “few-ta”) is confusing. That complexity sent subcommittee members searching…

May 30, 2024

Building a High Tech Workforce for the Future

The Wall Street Journal reported recently that a bidding war has broken out among the tech giants for scarce and valuable generative AI talent. This scramble is part of a much bigger talent shortage that looms over the US economy in coming years as AI becomes critical business infrastructure. Since generative AI (GAI) burst onto the scene in late 2022, the technology has sped ahead, driven…

May 29, 2024

Liberals Should Decide Whether Being a Homemaker Is Demeaning or Worthy of Huge New Government Benefits

Kansas City Chiefs kicker Harrison Butker struck a nerve. In a commencement address at Benedictine College in Kansas, he ventured to female graduates that some “careers in the world” are less fulfilling than many believe. He also suggested that being a homemaker is “one of the most important titles,” praising his wife Isabelle for “living her vocation…

May 29, 2024

Holding out Hope for a Left-Right Consensus on Federal Student Lending

For as long as we can remember, Republicans and Democrats have been talking past one another when it comes to federal student loan policy. Both sides of the aisle want students from all backgrounds to have access to a valuable and high quality education, but where progressives prioritize federal support, conservatives call for reining in…