Welcome to Our Research Archive

Search and filter by content type, issue area, author, and keyword

June 20, 2025

Senate Embraces “Do No Harm” for Higher Education

The Hippocratic Oath is coming for higher education. Last week, Senate Republicans released a package of higher education reforms that includes a “do no harm” standard for colleges: Degree programs would be ineligible for federal student loans if their former students’ earnings are too low. If enacted, the proposal would improve on the status quo, as the…

June 12, 2025

The Senate’s Higher Education Reforms Are Strong (But Could Be Stronger)

Senate Republicans recently unveiled their suite of higher education reform proposals, part of a broader tax-and-spending bill making its way through Congress. The package is strong: it would impose commonsense limits on federal student loans and create a saner loan repayment system. However, it forgoes obvious changes that would save taxpayers more money and would better hold…

May 12, 2025

To Improve Student Outcomes, Focus On Classroom Practice, Not Policy

Last week, I had the privilege of delivering keynote remarks at Marquette University Law School’s Lubar Center for a conference focused on redirecting K-12 education reform toward classroom teaching. Inspired by my recent Marquette Today piece, the event—hosted in collaboration with the College of Education—brought together educators, researchers, and policymakers to discuss how improving classroom practice…

May 7, 2025

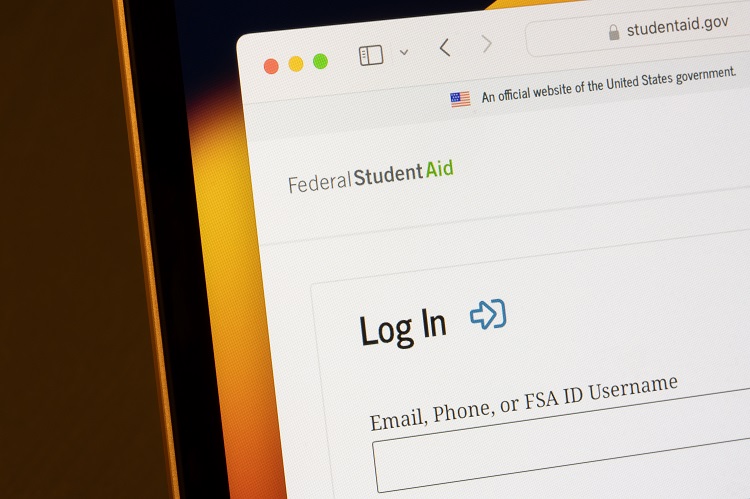

Colleges Must Help Return Student Borrowers to Repayment

The four-year pause on student loan payments has left behind an alarming fallout: Millions of student borrowers, having disengaged from the student loan system, are not making payments on their debts. Now, the Education Department is asking for help from colleges to get borrowers paying their loans again. On Monday, the Department issued a Dear Colleague Letter to…

April 28, 2025

House Republicans’ Proposed Repayment Plan Fixes Vexing Student Loan Problem

Congressional Republicans are undertaking a massive budget reconciliation effort involving significant reforms to the federal student loan system. House Republicans introduced their proposal on Monday, which would sweep away the maze of nearly a dozen different loan repayment plans and create just two: a standard repayment plan and an entirely new income-driven repayment (IDR) plan. In addition…

April 17, 2025

Turn Public Service Loan Forgiveness into a State Block Grant

As Congress negotiates a bill to overhaul the federal budget, lawmakers looking to save money should note $30 billion in potential savings hiding in plain sight. The Public Service Loan Forgiveness (PSLF) program, which fully discharges the student loans of borrowers who work for the government or a nonprofit for 10 years, is one of…

April 11, 2025

How The Trump Administration Can Address The Student Loan Nonpayment Crisis

After the federal government suspended student loan repayment for four and a half years, payments are finally due again—yet less than half of borrowers are repaying their debts on time. These high rates of student loan nonpayment threaten to ruin many borrowers’ credit records and send millions into default. Low student loan receipts could also cost taxpayers…

April 8, 2025

Could A Higher Endowment Tax Pressure Elite Schools To Expand?

Congressional Republicans are considering a significant hike in the excise tax on the endowments of rich universities as part of a broader tax reform effort. Most private universities with more than $500,000 in endowment assets per student are subject to a 1.4 percent excise tax on their net investment income. Some Republicans have proposed raising that tax rate to…

March 31, 2025

Reimagining Federal Education R&D: DARPA for Education

Earlier in my professional life, I was the head of the political science department at Stony Brook University. When the chairs of the arts and science met, someone from the physical or life sciences would inevitably argue that the “hard” natural sciences deserved more support than the “soft” social sciences. My rejoinder was one of…

March 25, 2025

Less Than Half of Student Borrowers Are Paying Their Loans

Student loan payments have been due for six months now—yet no one seems to have told the students. The federal government effectively suspended payments on student loans for four and a half years due to the Covid-19 pandemic, leading many borrowers to lose touch with their loan servicers and disengage from the repayment system. False promises of loan cancellation…