Welcome to Our Research Archive

Search and filter by content type, issue area, author, and keyword

- ✕ Clear Filter

- Child Tax Credit (9)

- Cost of Living (1)

- Earned Income Tax Credit (4)

- Economic Opportunity (1)

- Economic Opportunity and Mobility (1)

- Economic Well-Being (7)

- Featured (28)

- Fraud (1)

- poverty (7)

- Safety Net (6)

- SNAP (1)

- Society and Culture (1)

- State Policy (1)

- Tax & Transfer Policies (2)

- Temporary Assistance for Needy Families (TANF) (1)

- Trends and Measurement (2)

- Unemployment (3)

- Unemployment Insurance (15)

- Welfare (19)

May 30, 2024

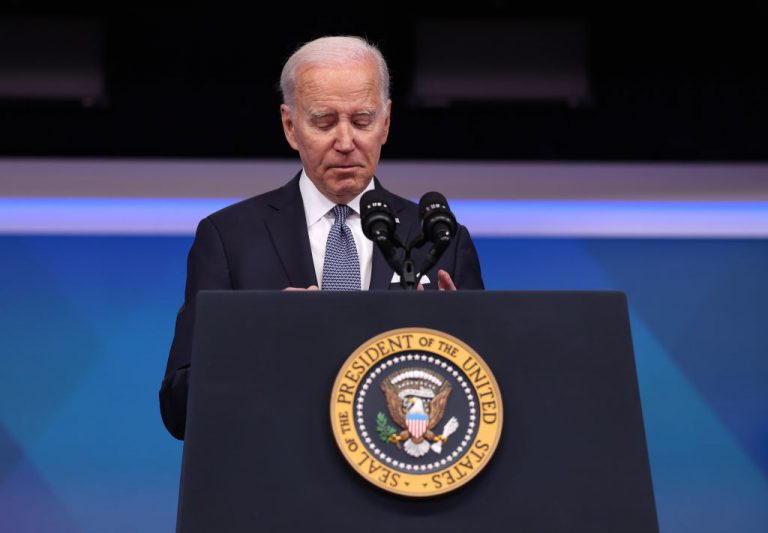

The Contradictions in Democrats’ Child Tax Credit Expansion Promises

Politicians regularly vie for the support of parents with promises of good schools, bigger family benefits, and tax relief. President Joe Biden did just that last week in calling for…

January 11, 2024

Tax Credit Nation — Politicians Are Casting New Spending As ‘Tax Cuts,’ Hiding Their True Cost

With the national debt soaring past $34 trillion, liberal politicians hoping to expand the federal leviathan face a conundrum. How can they convince Americans wary of the effects of runaway…

August 14, 2023

Tracking Plans to Make Pandemic Benefit Expansions Permanent

In 2008, former White House Chief of Staff and Chicago Mayor Rahm Emanuel famously said what has come to be known as Rahm’s rule: “You never want a serious crisis to go to…

August 3, 2023

Another Pandemic Legacy: Removing the EITC’s Work and Earnings Requirement

Since its origin in the 1970s, the Earned Income Tax Credit (EITC) has been the premier federal program promoting and rewarding work by low-income adults. As displayed below, taxpayers have…