July 16, 2025

An Analysis of the One Big Beautiful Bill Act’s Effect on Student Loans

Key Points Introduction At the beginning of July, President Donald Trump signed into law the One Big Beautiful Bill Act (OBBB), a comprehensive package of reforms to taxes and government spending.1 While the package touches on myriad policy areas, it includes a comprehensive set of reforms to the federal student loan program. These represent some of…

July 2, 2025

Congress Could Rein In Graduate Student Loans

Congress is on the verge of eliminating Grad PLUS—the program which extends effectively unlimited taxpayer-funded loans to graduate students—and imposing caps on graduate loans for the first time since 2006. On Tuesday, the Senate passed a budget reconciliation bill ending the program, which has fueled tuition hikes, exploded student debt, and padded the budgets of wealthy universities….

June 20, 2025

Senate Embraces “Do No Harm” for Higher Education

The Hippocratic Oath is coming for higher education. Last week, Senate Republicans released a package of higher education reforms that includes a “do no harm” standard for colleges: Degree programs would be ineligible for federal student loans if their former students’ earnings are too low. If enacted, the proposal would improve on the status quo, as the…

June 12, 2025

The Senate’s Higher Education Reforms Are Strong (But Could Be Stronger)

Senate Republicans recently unveiled their suite of higher education reform proposals, part of a broader tax-and-spending bill making its way through Congress. The package is strong: it would impose commonsense limits on federal student loans and create a saner loan repayment system. However, it forgoes obvious changes that would save taxpayers more money and would better hold…

May 22, 2025

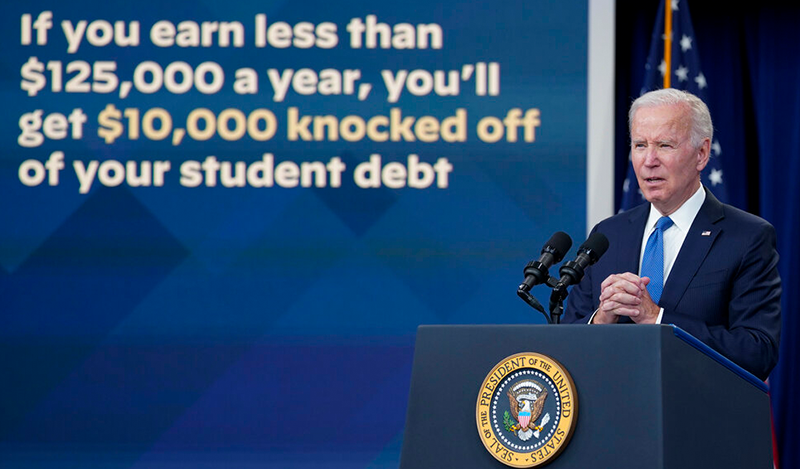

Course Correction: Rebuilding The Federal Student Loan System After Biden’s Mismanagement

Key Points Introduction Thirty-five million federal student loan borrowers went back into repayment in October 2024 after the government had suspended their student loan payments, in effect, for four and a half years. Already, delinquencies have shot up, and a wave of loan defaults looms. Borrowers will feel the pain—but so will the federal budget…

May 7, 2025

Colleges Must Help Return Student Borrowers to Repayment

The four-year pause on student loan payments has left behind an alarming fallout: Millions of student borrowers, having disengaged from the student loan system, are not making payments on their debts. Now, the Education Department is asking for help from colleges to get borrowers paying their loans again. On Monday, the Department issued a Dear Colleague Letter to…

May 5, 2025

What’s in House Republicans’ Student Loan Overhaul

House Republicans have introduced a comprehensive student loan overhaul as part of the broader budget reconciliation process. Known as the “Student Success and Taxpayer Savings Plan,” the package of reforms aims to save hundreds of billions of dollars through new student loan limits, changes to the repayment system, and policies to hold colleges accountable for their outcomes. If enacted,…

April 30, 2025

The Student Loan Bubble Is about to Pop

At the outset of the covid-19 pandemic, federal student-loan borrowers won what appeared to be a reprieve. That five-year pause on payments and interest accumulation is now shaping up to be a curse in disguise. Last week, the Trump administration drew criticism for announcing that the Education Department would resume involuntary collections next month. But the squeeze…

April 28, 2025

House Republicans’ Proposed Repayment Plan Fixes Vexing Student Loan Problem

Congressional Republicans are undertaking a massive budget reconciliation effort involving significant reforms to the federal student loan system. House Republicans introduced their proposal on Monday, which would sweep away the maze of nearly a dozen different loan repayment plans and create just two: a standard repayment plan and an entirely new income-driven repayment (IDR) plan. In addition…

April 25, 2025

Trump Administration Announces Plan to Get Borrowers Paying Student Loans Again

The U.S. Department of Education announced on Monday that it would resume involuntary collections of defaulted federal student loans on May 5. The announcement means that borrowers who have loans in default could see their tax refunds seized or wages garnished. While many borrowers and advocacy organizations will oppose the move, resuming collections is necessary to incentivize loan repayment….